Adani Wilmar Ltd (AWL) the equal joint venture between Adani Enterprises Ltd and Wilmar International Ltd, and the owner of the Fortune brand of edible oils, has set the price band for its public issue at Rs 218-230 per share, valuing the company at Rs 262.87 bn. The firm has cut its IPO size to Rs 36 bn from Rs 45 bn earlier. The proceeds from the issue worth Rs 19 bn will be used for capital expenditure, Rs 10.59 bn for repayment of debt and Rs 4.5 bn will be used for funding strategic acquisition and investment.

As a joint venture between the Adani Group and the Wilmar Group. Adani Wilmar Ltd benefits from its strong parentage. AWL is one of the few large FMCG food companies in India to offer most of the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses and sugar. The Company’s portfolio of products spans 3 categories: (i) edible oil, (ii) packaged food and FMCG, and (iii) industry essentials. They have a presence across a wide array of sub-categories within each of these 3 categories. A significant majority of their sales pertain to branded products accounting for approximately 73% of their edible oil and food and FMCG sales volume for the financial year 2021.

As of March 31, 2021, the Refined Oil in Consumer Packs (“ROCP”) market share of their branded edible oil was 18.3%, putting them as the dominant No. 1 edible oil brand in India. “Fortune”, their flagship brand, is the largest selling edible oil brand in India. Adani Wilmar Ltd has also offered a wide array of packaged foods since 2013, including packaged wheat flour, rice, pulses, besan, sugar, soya chunks and ready-to-cook khichdi. They also offer a diverse range of industry essentials, including oleochemicals, castor oil and its derivatives and de-oiled cakes.

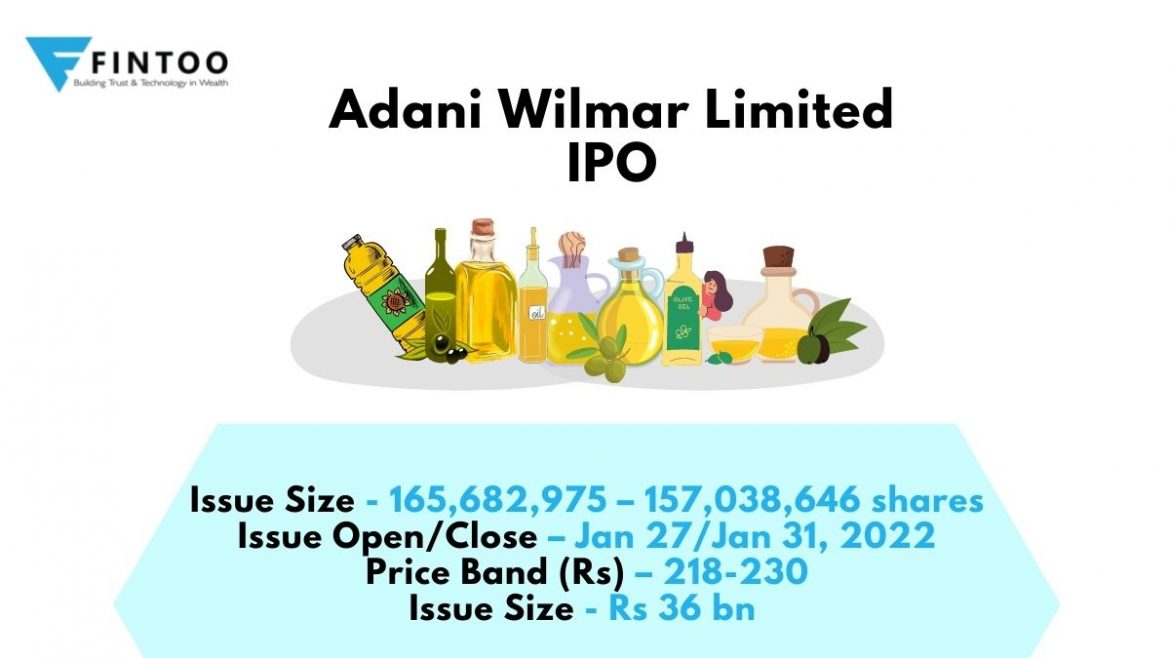

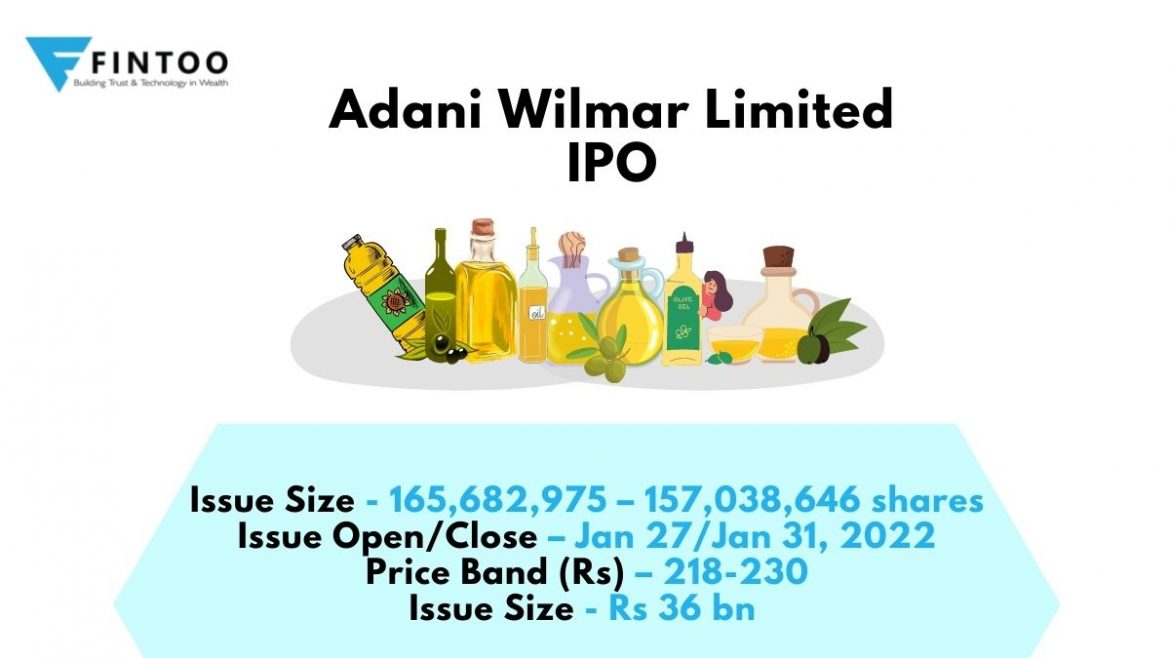

| Issue Size- 165,682,975 – 157,038,646 shares | Issue Open/Close – Jan 27/Jan 31, 2022 |

| Price Band (Rs) 218-230 | Issue Size- Rs 36 bn |

| Face Value (Rs) 1 | Lot Size (shares) 65 |

Competitive Strengths

- Differentiated and diversified product portfolio with market leading brands to capture large share of kitchen spends across India

- Leading consumer product company in India with leadership in branded edible oil and packaged food business

- Market leading position in industry essentials

- Strong raw material sourcing capabilities

- Integrated business model with well-established operational infrastructure and strong manufacturing capabilities

- Extensive pan-India distribution network

- Focus on environmental and social sustainability

- Strong parentage with professional management and experienced board

Key Risks

- The company derives a significant portion of revenues from edible oil business segment in India contributing 74.80% and 79.16% of the revenues for the five months ended Aug 31, 2021 and Fiscal 2021 respectively.

- The company depends significantly on imports of raw materials/finished goods in addition to domestic supplies.

Valuation

- The Adani Group is coming out with a public issue after nearly 12 years. The Group stocks are fancied across the board by investors, thus we may see interest in this issue. Annualizing FY22 earnings, the issue quotes at a P/E of 44.7. Though the issue is fully priced, investors may consider an investment with a long-term perspective.

Must Read: 2022! Is It A ‘Bubble’, Ready To Pop?

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning without any cost on: http://bit.ly/Robo-Fintoo

Disclaimer: The views shared in blogs are based on personal opinion and does not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.