Mutual Funds are one of the best investment avenues when it comes to creating wealth in the long term. In order to grow your wealth, your portfolio needs to beat inflation and mutual fund is an investment avenue which ensures that you beat inflation in the long term.

It seems quite convenient for those who do not want to jump into the market directly. Since mutual funds are professionally managed and fetch reasonable returns adjusted to risk appetite (as per the investment strategy of the fund), they have become investor’s favorite, be it conservative or be it, aggressive investor.

If you have made up your mind to invest in mutual funds, it is important that you know the tax implications of the same. You cannot ignore taxes while investing in mutual funds.

“How much tax I need to pay on mutual funds?”

You must have this question in mind. But the answer is not direct. The amount of tax that you need to pay depends on various factors. These are:-

- Type of Income

- Type of Mutual Fund

- Holding period of investment

- Type of transaction

Let us take this one by one

Type of Income

When do we pay income tax?

As simple as it may sound, we pay tax only when we earn income, right?

So what kind of income is generated when we invest in mutual funds?

There are two types of incomes generated through Mutual funds –

- Dividend Income

- Gain on selling mutual funds

These are the two instances where we gain out of mutual funds. Tax treatment is different in both instances.

Let us first focus on dividend income

- Dividend Income

Regarding dividend income, there have been recent changes in Budget 2020 on how dividend income needs to be taxed. The finance minister has proposed the abolition of DDT and made the dividend income taxable in the hands of the investor.

Now the question comes, how much tax you need to pay on dividend income.

The answer is simple. Dividend income from mutual funds is taxed as per slab rates.

- Gain on selling Mutual Funds

Apart from dividends, you can earn through capital Gains from mutual funds. Let me clear one point here, capital gain here refers to the gain you get when you sell your mutual funds and not on notional gains.

Thus, we can say

Capital Gain = Redeemed Value – Cost of investment.

Now the main question, how much tax needs to be paid on capital gains?

It does not have a one-word answer. It depends on what kind of mutual fund it is. This brings us to the next factor i.e. “Type of Mutual Fund”

Type of Mutual Fund

The amount of tax to be paid on capital gains depends on which type of mutual funds you had invested in.

As per Mutual fund scheme rationalization and categorizations, SEBI has provided the following classification of mutual funds namely-

- Equity Mutual Funds

- Debt Mutual Funds

- Hybrid Mutual Funds

- Solution oriented Funds

- Others

Each of the above categories has subtypes as well. For example, there are 11 different types of equity funds and 16 different types of debt mutual funds.

But don’t worry! From a tax perspective, all these funds are divided only into 2 categories. This means there are only two types of mutual funds that you need to consider to find out how much tax you need to pay. These are:

1.Equity Oriented Mutual Funds

All the types of equity mutual funds come under this category. Not only this, any mutual fund which has an equity exposure of 65% or above will become under this category. This implies that balanced funds where equity holdings are 65% or more will come under this classification.

2.Other Funds

All the funds which do not fall in the above category come in the “Other Category”. This includes all debt funds, Gold funds, real estate funds, any balanced fund where equity exposure is less than 65%.

Now once we know these two categories, it is simple to know the tax implication on these mutual funds. This is because the tax rate on Equity oriented mutual funds is different from all other funds.

However, there is one more step. This next step is to find out what is the holding period of these investments.

What does holding period mean? That is our next factor – Holding period of investment.

Holding Period of Investment

Holding period means that for how many months you hold on to that particular mutual fund before you sell. Based on this we have two types of gain i.e.

- Short term Capital Gain

- Long term Capital Gain

Short-term capital gain is when an investor receives gain by selling an investment in a short duration and long-term capital gain is when an investor receives gain by selling an investment in a long duration.

Now the question comes, how do we define short term and long term.

Short term and long term holding period differ for equity-oriented mutual funds and other funds. That is the reason we covered that part first.

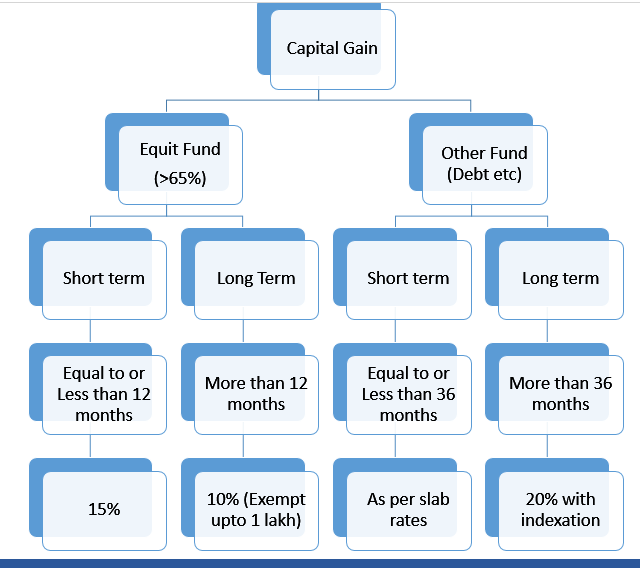

The below chart explains the short term and long term holding periods along with the applicable tax rate.

Type of Transaction

Now that we are clear with all tax rules, I would now like to specify a few common transactions to make it clearer. In mutual funds we have the following transactions:-

- Lumpsum purchase

- SIP

- SWP

- STP

- Switch

- Redemption

Related Article : Understanding SIP, SWP and STP

No income tax you need to pay when you are making an investment whether Lumpsum or SIP. However, if you are making this investment in an ELSS fund (Equity Linked Saving Scheme) then, you are eligible for an 80c deduction up to Rs. 1,50,000.

Transactions like SWP (Systematic Withdrawal plan), STP (Systematic Transfer Plan), Switch, Redemption are considered as selling units i.e. redemption only. So the treatment will be the same as described above. That is, first you need to check which type of fund and then holding period.

Securities Transaction Tax (STT)

Apart from income tax, you also need to pay STT. STT is to be paid on transaction value and not on gain amount.

How much STT needs to be paid?

An STT of 0.001% is levied by the government (Ministry of Finance) when you decide to sell your units of an equity fund or an equity-oriented fund. There is no STT on the sale of debt fund units.

To summarise, an investor first needs to check whether the income is through a dividend or capital gains. If it is capital gain, check the type of fund – Equity or other. Next check the holding period and tax rate applicable. This was a 360-degree view on tax implications on mutual fund investments. I hope it has given you a better understanding.

Related Posts

Stay up-to-date with the latest information.