How many of you are familiar with STPs?

I’m sure not many of you. Now with so many investment options available, people are confused in what to invest, where to invest and how to invest. Some people do not know what are the investment options available, and how to make the best use of them.

You may have different goals and dreams in life, but to fund those goals is a big task. It is always suggested that if you don’t know your way through the market, you seek help from an advisor. They will be able to guide you in the right path and help you build a bridge between your funds and goals.

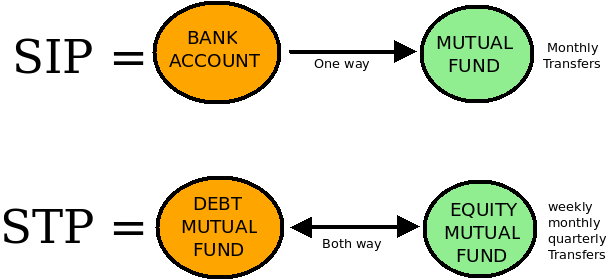

You must be aware of Systematic Investment Plan (SIP) which is one good option to invest in mutual funds. In SIP, a fixed amount is deducted from your savings account every month and directed towards the mutual fund you choose to invest in. Systematic Investment Plans are a disciplined way to start investing to create wealth for the longer period of term.SIPs bring about a good saving habit in one’s routine, which is necessary.

Read More :- Importance of Continuing SIPs Amid COVID-19

Another option is STP (Systematic Transfer Plans), this is good for those investors who do not want to take the risk of investing a lump sum amount in a particular fund at one go. Especially in the current scenario, where the market is volatile due to COVID-19 pandemic, it is suggested to not invest lump sum. So Systematic Transfer Plans comes to your rescue.

Under Systematic Transfer Plans, an investor can invest a lump sum amount in a fund and transfer regular amounts, which are predefined by the investor, to another fund, on a specified date. You can make these transfers on a monthly, quarterly or even weekly basis. This is a better option than directly investing the whole lumpsum amount in a risky fund.

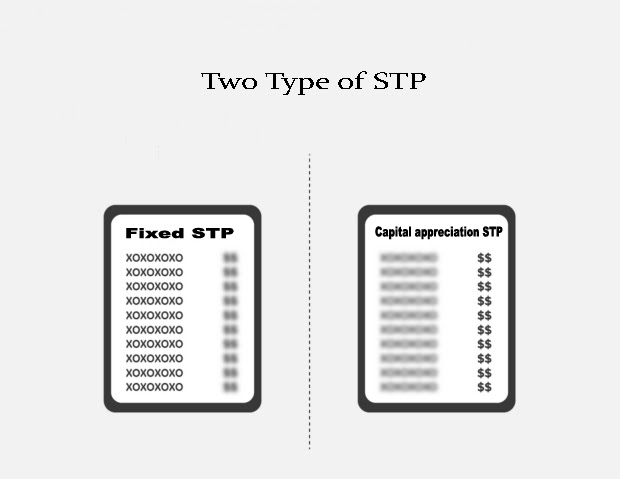

There are 2 types of STPs:

- Fixed STP: Over here, the amount that is to be transferred from one scheme to another is fixed. For example, Mr. A invested Rs. 100000/- in a fund ABC, and he has opted for a STP to fund XYZ, he wants Rs 5000/- to be transferred to fund XYZ on a monthly basis. Here we can see that Rs. 5000/- is the fixed amount that is to be transferred.

- Capital appreciation STP: Under this, the amount that is to be transferred will depend on the profit earned. This means that the investors want only the profit amount to be transferred to the other fund. Let us take the same above example to get a better idea, If after investing Rs. 1 lakh in fund ABC, he gains Rs. 6000/- (after a few months or a year) on it, the same amount of 6000 will be transferred to fund XYZ.

Now lets see how STP is relevant to you.

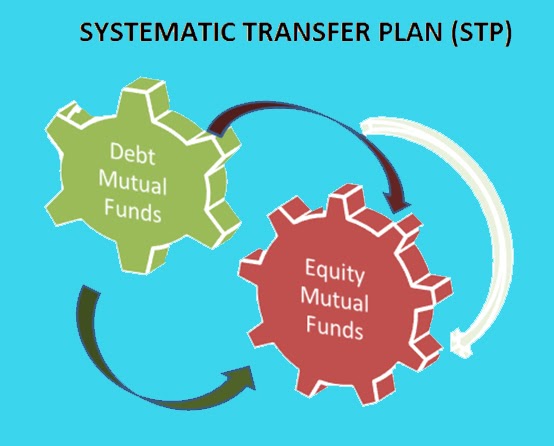

If an investor, who has a lump sum amount to invest, doesn’t want direct exposure in the equity market, can invest his lumpsum amount in a debt fund and through STP, transfer the amount he wishes to in the equity fund.

He can make the transfers monthly, quarterly or even weekly, as he wishes. However, one must keep in mind that, whenever an amount is transferred from one fund to the other, the units of that fund, from which money is going out, becomes less and units of the fund where the money is transferred increases.

Lets say, if the funds are being transferred from debt to equity, then the units in the debt fund will reduce and the units in the equity fund will increase.

Read More :- Understanding SIP, SWP and STP

STPs from debt to equities are more effective, when markets are volatile, and an investor does not want to take a risk. STPs are a better option than one time investments, in cases when the market is down which we are experiencing right now because of global pandemic. However, if we look at it the other way round, then one time investments would be a better option, if the markets are moving upwards. Having said all this, it is very difficult to predict the market scenario for a retail investor. So it is better for them to invest through STPs and get better risk adjusted returns, over a period of time.

STPs help investors reduce their risk, if the regular transfers are maintained. Just like how the concept of Rupee Cost Averaging works for a SIP, it can be applicable to a STP also. People usually think that when the market is down, they should redeem their money, before they make a bigger loss. However, people investing through SIPs, can avail this benefit.

Let us continue with earlier example to understand above point:

Mr. A invested Rs. 100000/- in a fund ABC, and he has opted for a STP to fund XYZ, he wants Rs 5000/- to be transferred to fund XYZ on a monthly basis. Now let us say in the 1st month, the NAV of fund XYZ was Rs. 10/-. So the no. units added will be 500 (5000/10). After a few months, if the NAV drops to Rs. 8/-, 625 (5000/8) more units will be added to the XYZ fund compared to 500 earlier.

In this example, you can see how an investor can take the advantage of the market when it drops. This example is taken also with a few months gap. Now, imagine if an investor keeps his money for years, how much will he gain.

STP is a tool to reduce risk, like SIP. The transfers should be made in a disciplined manner to avail this benefit. Well now you’ve understood all you need to know about STPs, so you can start planning for your investments, and make use of the funds you have in a proper and ‘Systematic’ way even during the current volatile market owing to COVID-19.

You may start investing now in mutual funds through SIP/STP Online via Fintoo or download our application Fintoo

Related Posts

Stay up-to-date with the latest information.