Thinking of investing in hybrid funds? Have a complete knowledge of them before you do.

The mutual fund market is vast. There are thousands of scheme and also different categories of schemes. You can find equity funds, debt funds, hybrid funds, solution-oriented funds, etc. This wide variety of choice makes an amateur investor confused. Take the instance of a hybrid fund. Where equity and debt funds are easily understood, investors get confused when it comes to investing in a hybrid fund. They don’t understand whether they are investing in equity or debt or a mixture of both. Do you?

If you are looking to explore hybrid funds for your investments, understand what these funds are and what they promise. Interested? Let’s roll –

1. What are hybrid funds?

The Oxford Dictionary defines the word ‘hybrid’ as ‘a thing made by combining two different elements’. Thus, a hybrid fund is a fund which combines different assets in its portfolio. Hybrid fund represents a mix of equity, debt, money-market investments and also cash holdings. The risk, return and taxation of a hybrid fund depend on its asset class.

2. Types of hybrid funds

Based on the portfolio, hybrid funds are further classified into different categories. The primary categories are as follows –

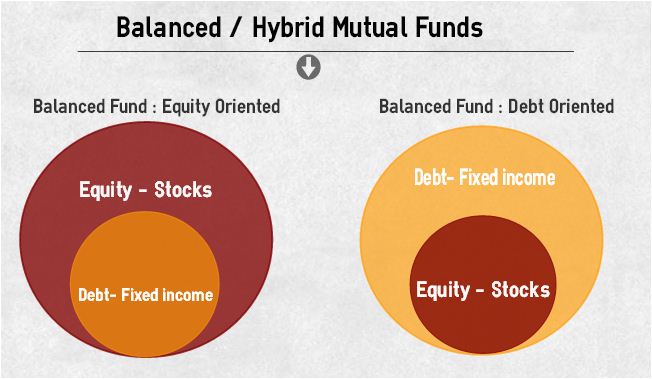

- Equity oriented hybrid funds

Popularly known as balanced funds, equity oriented hybrid funds invest at least 65% of their portfolio in equity oriented securities. The remainder is invested in debt instruments and a little portion might also be held in money-market investments. Since equity exposure is high, the fund is volatile. However, since the portfolio also consists of debt, the volatility is reduced. Taxation is similar to equity mutual funds as the portfolio leans towards equity exposure. Thus, you get tax-free returns up to 1,00,000 if you redeem these funds after 12 months. In case your gain amount is more than 1 lac then you need to pay 10% on the excess amount. If the holding period is less than 12 months, then the gains are taxed at 15%. Balanced funds are suitable for investors just starting their mutual fund journey as they can enjoy low risk and good returns.

- Debt oriented hybrid funds

These funds are also called Monthly Income Plans (MIPs). At least 70% to 85% of the portfolio is invested in debt securities and fixed-income instruments. Equity exposure is limited to up to 30%. Being MIPs, these funds may provide regular returns in the form of dividends if you choose the dividend option. You can receive incomes monthly, quarterly, half-yearly or annually. There are growth option too wherein you don’t get returns. The returns remain invested and grow. These funds are taxed like debt mutual funds. If you redeem the fund within 3 years, you would earn short term capital gains and be taxed at your tax slab. If, however, the fund is redeemed after 3 years it qualifies for long term capital gain. You are taxed at 20% with the benefit of indexation. Returns of these funds could be higher than debt funds because of equity exposure in the fund.

- Arbitrage funds

These funds are specialized funds which try and generate return from the differential pricing of a stock in the derivatives market and the futures market. Arbitrage funds are considered to be equity-oriented funds and are taxed accordingly. However, they enjoy low volatility. Thus, arbitrage funds combine the benefit of both equity and debt funds.

3. Benefits of hybrid funds

Hybrid mutual funds provide good benefits and therefore they are chosen by many investors. Some popular benefits provided by these funds are as follows –

- Since these funds have both equity and debt investments, you can benefit from the high returns promised by equity while the volatility is cushioned out by debt. Thus, you get double benefits of equity and debt from hybrid funds.

- Hybrid funds are apt for new investors who want to test the waters. They have lower risk appetite and higher return expectations, a combination which is available only with a hybrid fund.

- Hybrid funds rebalance their portfolio automatically to attain the desired asset allocation of the scheme. This rebalancing frees you from timing the market, gives you risk-adjusted returns and also provides stability to the portfolio.

Read here: Should You Invest Directly In Equity Or Via Mutual Funds?

So, if you are looking to taste hybrid fund investments, know about the fund, its types, the risk associated, the return potential and the tax treatment. Invest only after you are clear on these parameters to avoid unpleasant surprises. Take assistance from Mutual Fund experts for guidance.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning without any cost on: http://bit.ly/Robo-Fintoo

To Invest and keep regular track of your portfolio download: Fintoo App Android http://bit.ly/2TPeIgX / Fintoo App iOS http://apple.co/2Nt75LP

Disclaimer: The views shared in blogs are based on personal opinion and does not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.