Life is full of uncertainties, and while we can’t predict what lies ahead, we can certainly take steps to protect our loved ones.

One of the most effective ways to ensure that your family remains financially secure in case something happens to you is by choosing a term insurance plan. In this guide, we’ll explore what term insurance is, its advantages, and how to choose the best plan for your needs.

Let’s dive in!

What is a Term Insurance Plan?

A term insurance plan is a type of life insurance policy that provides coverage for a specific duration, or “term.” If the policyholder passes away during the term, their beneficiaries receive a death benefit.

This benefit can help cover living expenses, pay off debts, or maintain the family’s lifestyle.

Term insurance is often called pure life insurance because it doesn’t have any investment or savings components attached. Instead, it focuses solely on providing financial protection.

Unlike traditional life insurance policies, which often include investment options or cash-value accumulation, term insurance is straightforward and affordable.

The primary objective of term insurance is to ensure your family’s well-being after your death without the complexities of investment-linked plans.

Term Insurance vs. Life Insurance: What’s the Difference?

When it comes to life insurance, two main types often come up: term insurance and whole life insurance (or other forms of life insurance). The major differences between the two are:

- Term Insurance: Provides coverage for a set period (e.g., 10, 20, or 30 years) and only pays out a death benefit if the insured dies during that term. It has no cash value or investment component, making it the most affordable life insurance option.

- Life Insurance (Whole Life or Endowment): This offers lifetime coverage and includes a savings or investment component. It typically costs more than term insurance as it combines both life coverage and wealth accumulation features.

In summary, if you’re looking for affordable protection for a specific period with no extra frills, term insurance is likely the better option.

Is Term Insurance Worth It?

The short answer is: Yes! Term insurance is worth it and is one of the most cost-effective ways to ensure your family’s financial security. Here’s why:

- Affordable Premiums: Term insurance plans offer high coverage at a fraction of the cost compared to other types of life insurance.

- Simplicity: With no investment component or complex terms, term insurance is straightforward to understand. It’s focused solely on protection, making it ideal for those who just want life coverage.

- Peace of Mind: The main benefit of term insurance is the peace of mind it offers, knowing that your family will be taken care of financially, even if something happens to you.

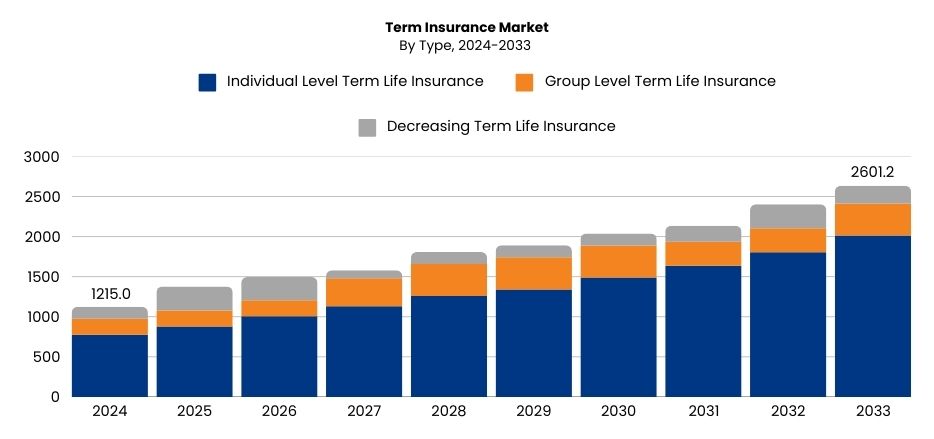

So, if your primary goal is providing financial security for your family at an affordable cost, term insurance is worth it. The term Insurance market is expected to reach a market value of USD 2,601.2 billion by 2033 at a CAGR of 8.8%.

Advantages of Term Insurance

- Low Premiums for High Coverage:

One of the biggest reasons term insurance is so popular is its affordability. Compared to other types of life insurance, term plans are extremely cost-effective. This means you can get significant coverage at a relatively low premium.

Whether you’re looking to protect your family against your absence or to cover specific financial obligations like a home loan, term insurance is an excellent choice. - Simplicity and Transparency:

Unlike whole life insurance policies that can be confusing with their investment components and varying terms, term insurance is simple. You pay a fixed premium, and your beneficiaries are provided with a death benefit in case of your untimely death.

This straightforward structure makes it easy for anyone to understand what they’re signing up for. - Flexibility in Policy Term:

Term insurance plans typically allow you to choose the duration of coverage. You can opt for a policy that lasts anywhere from 10 to 30 years.

This flexibility ensures that you can tailor the plan to suit your current life stage and financial responsibilities. For example, you may only need coverage for the duration of your mortgage or until your children are financially independent. - Tax Benefits:

Term insurance policies come with attractive tax benefits, which can make them even more appealing.

The premium payments made toward term life insurance are eligible for a deduction under Section 80C of the Income Tax Act, up to ₹1.5 lakh per annum. Furthermore, the death benefit paid to your beneficiaries is tax-free under Section 10(10D). - Riders and Add-Ons for Extra Protection:

Many term insurance plans allow you to add riders—additional benefits that provide extra coverage. These could include accidental death benefit riders, critical illness riders, or income benefit riders.

These add-ons are typically available for a nominal cost and can provide more comprehensive protection for your family. - Income Replacement and Debt Repayment:

A major benefit of term insurance is its ability to replace lost income. For a family, losing the primary breadwinner can be financially devastating.

A term insurance policy ensures that your family will have the financial resources to cover daily living expenses and long-term financial goals.

Additionally, if you have outstanding debts, a term plan can help ensure those are paid off, relieving your family from the burden.

Claim Settlement Ratio of Life Insurance Companies 2024 (by Amount):

The claim settlement ratio indicates the percentage of claims an insurer has successfully paid out in a financial year. A higher ratio reflects a more reliable insurer, making it a key factor to consider when choosing or renewing a policy.

| Insurance Company | Total Claims (₹ Crore) | Claims Paid (₹ Crore) | Claim Settlement Ratio (%) |

| Argon | 30.09 | 28.11 | 93.37% |

| Intra | 95.55 | 86.38 | 90.42% |

| Band Axa | 30.73 | 26.82 | 87.31% |

| Pramerica Life | 26.39 | 20.62 | 78.12% |

| HDFC Life | 3440.2 | 1589.3 | 96.32% |

| Sahana | 3.2 | 3 | 93.80% |

| Canara HSBC OBC | 39.36 | 36.13 | 91.80% |

| PNB Met Life | 42.53 | 40.23 | 94.57% |

| LIC | 15370.231 | 14997.77 | 97.57% |

| SBI Life | 3948.28 | 3612.85 | 91.49% |

| Man Life | 232.47 | 210.23 | 90.42% |

| Tata AIA | 521.7 | 776.7 | 94.37% |

| Bajaj Allianz | 653.8 | 621.35 | 92.25% |

| Kotak Mahindra | 639.5 | 603.05 | 94.23% |

| Edelweiss Tokio | 630.5 | 590 | 93.60% |

| Star Union | 115.6 | 113.06 | 97.81% |

| Reliance Nippon | 219.25 | 204.08 | 93.07% |

| Aditya Birla Sun Life | 810.48 | 812.62 | 98.22% |

| India First | 314.5 | 294.82 | 93.75% |

| ICICI Prudential | 3126.25 | 2970.42 | 95.00% |

| Ageas Federal | 674.7 | 612.89 | 90.83% |

| Future Generali | 309.49 | 240.82 | 77.83% |

| Shriram | 3022.41 | 2562.02 | 78.25% |

| Private Sector Total | 3055.55 | 2683.21 | 87.83% |

| Grand Total | 30221.41 | 26812.21 | 91.49% |

Disadvantages of Term Insurance

While term insurance is a fantastic option for many, there are a few things to consider before making your decision:

- No Cash Value: Unlike other types of life insurance, term insurance doesn’t accumulate any cash value. If you outlive your policy term, you won’t receive any payout or benefits.

- Renewal May Be Expensive: If you need to renew your policy after the term ends, the premiums may be significantly higher, especially as you get older.

- No Investment Component: Term insurance focuses purely on life coverage. While this makes it affordable, it also means you won’t build any wealth or savings through the policy.

Things to Know Before Choosing a Term Insurance Plan

When it comes to purchasing a term insurance plan, there are a few key factors you need to consider:

- Determine Your Coverage Needs: It’s crucial to calculate how much coverage you need based on your income, debts, and your family’s future expenses. A good rule of thumb is to choose a coverage amount that’s at least 8-10 times your annual income. You can also use online calculators to estimate your ideal coverage.

- Choose the Right Policy Term: Consider your current and future needs when selecting the term length. If you have young children or a mortgage, a longer policy term may be the right choice.

- Understand the Premiums: The earlier you purchase a term insurance policy, the lower your premiums will be. Also, remember that premiums are fixed once you buy the policy, ensuring that your family will always have affordable protection.

- Look for Riders: Riders are optional add-ons that enhance your term insurance coverage, offering extra protection for specific risks. These benefits, available at an additional cost, allow you to customize your policy to suit your needs. Common riders include:

- Accidental Death Cover Rider: Provides an additional payout if death occurs due to an accident.

- Critical Illness Rider: Offers a lump sum payout upon diagnosis of severe illnesses like cancer or heart attack.

- Waiver of Premium Rider: Ensures your policy remains active without further premium payments if you become critically ill or disabled.

- Disability Benefit Rider: Provides financial support through a lump sum or monthly payouts in case of permanent disability due to an accident or illness.

- Income Benefit Rider: This guarantees a steady income for your family in case of your untimely passing.

Choosing the right riders can significantly enhance your policy’s coverage and provide greater financial security.

How to Choose the Right Term Insurance Plan

Choosing the right term insurance plan can feel overwhelming with so many options out there. Here’s how to make it easier:

1. Evaluate Your Family’s Financial Needs:

- Understand Your Human Life Value (HLV): The Human Life Value (HLV) concept helps estimate the financial loss your family would incur in your absence. It considers your income, expenses, liabilities, and future financial commitments.

- Assess Essential Expenses: Calculate the amount required to maintain your family’s lifestyle, covering daily expenses, rent, utilities, and other necessities.

- Account for Outstanding Liabilities: Factor in any existing loans, such as home loans, personal loans, or credit card debts, to prevent leaving a financial burden.

- Plan for Future Goals: Consider major life expenses like your children’s education, wedding, and retirement needs for your spouse.

- Determine Adequate Insurance Cover: Use the Human Life Value Calculator to estimate the protection cover required to ensure your family’s financial security.

2. Compare Different Plans: Look at several insurance policies to compare premiums, coverage, and additional benefits. Use online comparison tools to make the process easier.

3. Check the Insurer’s Reputation: Always choose a reputable insurance company with good customer service and a strong claims settlement record.

4. Consider Buying Online: Online policies are often cheaper and quicker to purchase. Many insurers offer discounts for purchasing directly through their websites.

5. Nominee of the Policy: Choosing a nominee is crucial, as they will receive the claim amount if you pass away while the policy is active. You can nominate a trusted family member, such as your spouse, children, parents, or siblings, to ensure financial stability for your loved ones.

6. Get Expert Guidance with Financial Advisors: Purchasing term insurance is crucial for your family’s future. To make the right choice, consult a trusted financial advisor like Fintoo, who can help you select the best policy, customize it with suitable features, and ensure a smooth claims process for your family when they need it the most.

Final Thoughts: Protect Your Family’s Future Today

Investing in a term insurance plan is one of the most thoughtful and responsible decisions you can make to protect your family. With its low premiums, high coverage, and simple structure, term insurance provides affordable financial security in times of uncertainty. Whether you’re just starting your career or planning for retirement, term insurance is an essential part of any solid financial plan.

If you’re ready to secure your family’s future, contact a Fintoo Wealth Advisor today to help you choose the perfect plan. The earlier you act, the better the protection for your loved ones.

Frequently Asked Questions

- Can I change my beneficiary on a term insurance policy?

Yes, most term insurance plans allow you to change the beneficiary during the policy term. Make sure to check with your insurer about the procedure. - What happens if I miss a premium payment?

Most insurers offer a grace period for missed payments. However, if you fail to pay within the grace period, the policy may lapse. Always keep track of your premiums to ensure continuous coverage. - Is it worth getting a term plan if I already have life insurance through my employer?

While employer-provided insurance is a great benefit, it often isn’t enough to cover your family’s full financial needs. A personal term insurance plan can provide extra protection. - Can I get a term insurance policy for my children?

Generally, term insurance is for adults, but some plans allow parents to purchase insurance for their children. This can provide early protection for their future. - How do I know if I have enough coverage?

You can use a Human Life Value calculator to determine the right amount of coverage or consult a financial advisor to help assess your family’s financial needs.

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Investing using the app is the sole decision of the investor and the company or any of its communications cannot be held responsible for it.