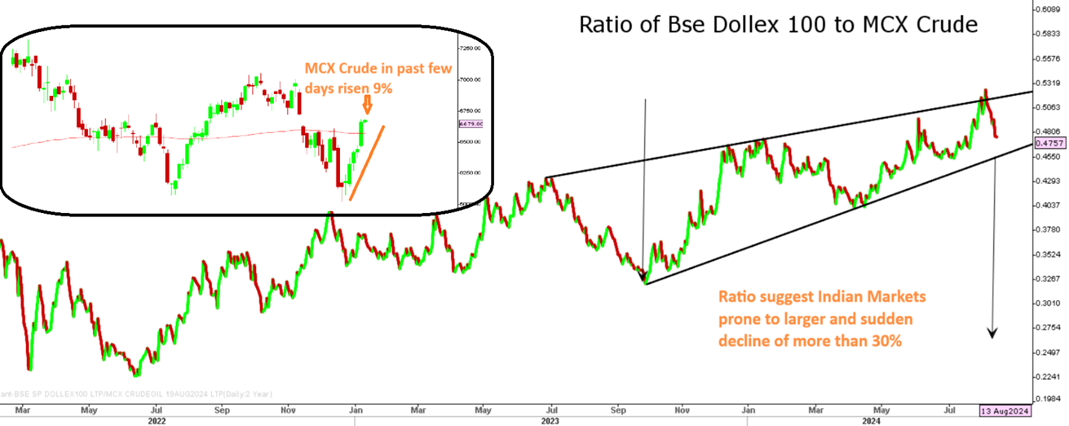

Markets failed to trigger larger decline despite Hindenburg revelation on SEBI chief with Nifty managed to recoup most of losses and ended on a flat note. At present, the key risk for Indian markets remains from movement in Japanese Yen and we expect Nifty to trigger follow-up selling towards 22,500 on back of JPYINR rising above 57.50. In the past few days, crude prices have seen surge of 8% and a further rally is expected to trigger larger breakout for surprising upside of 30% in the near term.

Results Today – Hindalco, Apollo Hospitals, Hero MotoCorp, IRCTC, MTAR Technology

Ratio of Indian markets to Crude Oil

Stocks to watch

Positive Read through

- JSW Steel – To acquire 66.67 pct interest in M Res NSW for USD 120 mn.

- Power Grid – Successful bidder under TBCB for an inter-state transmission project.

- Marico – Manufacturing operations in Bangladesh have resumed at normal scale.

- Vodafone Idea – Losses came at lowest in 14 quarters, margin stable at 40 pct.

- Happiest Minds – USD sales up 10.9 pct, CC sales growth at 11.4 pct QoQ.

- Wipro – Expands partnership with Google for cloud AI.

- NMDC – Posted Q1 above estimates, average realisations rose YoY & QoQ.

- Doms – EBITDA jumped 38 pct, margin improves 290 bps YoY.

- Hind Copper – Margin at 38.2 pct vs 22.4 pct, sales increased 33 pct YoY.

- Alembic – EBITDA up 89 pct, margin at 40.4 pct vs 29.5 pct YoY.

- Power Mech – EBITDA up 14.4 pct, sales increased 16.4 pct YoY.

- Orchid Pharma – EBITDA grew 46.6 pct, margin at 13.3 pct vs 12.1 pct YoY.

- HUDCO – Asset quality improves, disbursements up 19x YoY.

- IRFC – NII up nearly 2 pct, profit increased 1.7 pct YoY.

- Olectra Green – EBITDA up 4.5 pct, sales increased 45.3 pct YoY.

- Oberoi Realty – NCLT nod to acquire Nirmal Life via IBC by paying creditors Rs. 2.73 bn.

Negative Read through

- Senco – Reported Q1 in-line, customs duty reduction will impact margin for next 2-3 quarters.

- Ami Organics – EBITDA fell 13.2 pct, margin at 16.7 pct vs 22.1 pct YoY.

- 63 Moons – Posted loss vs profit, sales tumbled 66.3 pct YoY.

- RCF – EBITDA down 10.4 pct, margin at 2.6 pct vs 3.2 pct YoY.

- ΚPI Green – To raise up to Rs. 10 bn via QIP, issue price Rs. 935 per share.

- HOEC – EBITDA fell 29.3 pct, margin at 42.5 pct vs 48.9 pct YoY.

- Globus – EBITDA dropped 34.4 pct, margin at 7.4 pct vs 12.7 pct YoY.

- Camlin Fine – EBITDA down 53.7 pct, margin at 4.5 pct vs 9.2 pct YoY.

- Yatra – EBITDA down 70 pct, margin at 4.6 pct vs 14.4 pct YoY.

- Campus active – EBITDA down 22 pct, margin at 15.3 pct vs 18.7 pct YoY.

- Spice Jet – Company’s operation from CSMIA expected to be temporarily disrupted.

Financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 2499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.