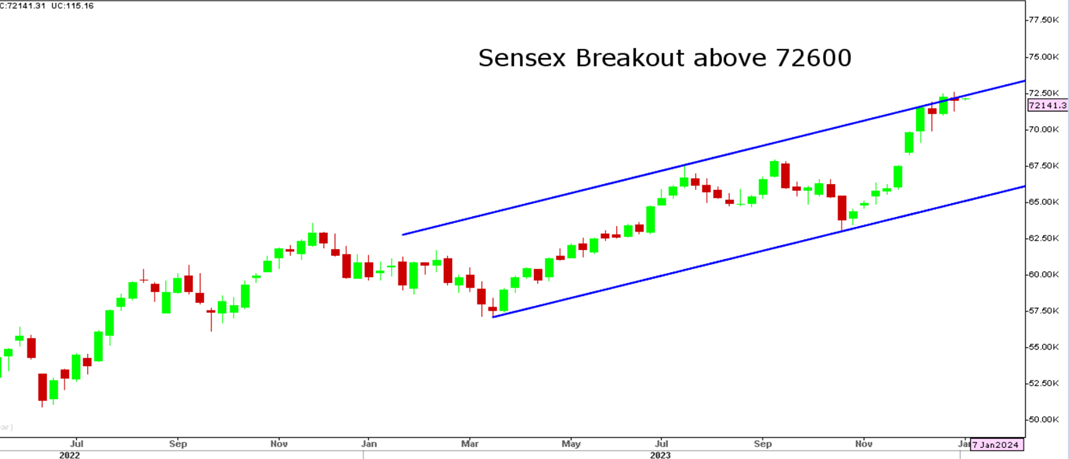

Markets succumbed to selling pressure on Monday after Sensex failed to cross the resistance of rising channel and followed with closing almost 1% lower with major selling seen in Nifty Bank. At present, markets are trading at a crucial juncture and prone to major downside risk in the coming days. With JPYINR already positioned to rise by 11%, we can expect major pressure on Financials and Technology stocks. On the downside, crucial trend reversal would be confirmed on close below 71,000 in Sensex.

Result Today – Delta Corp

Sensex 30 Chart

Stocks to watch

Positive Read through

- Bajaj Auto – Announces Rs. 40 bn share buyback at Rs. 10,000/sh, 43 pct premium to cmp.

- Τata Motors – JLR delivers highest wholesales in 11 quarters during Q3, up 27 pct YoY.

- Adani Ent – Tribunal orders refund of monthly annual fee for covid period to Mumbai Airport.

- Eicher Motors – Royal Enfield signs MoU to invest Rs. 30 bn in Tamil Nadu.

- Cipla – JV in US with Kemwell Bio & Manipal Education for cell therapy pdts.

- Bandhan bank – As per report, no forensic audit by RBI regulator, audit will be by CGFMU.

- Metropolis Health – Q3 core business sales up 12 pct, volume growth came at 9 pct YoY.

- Aurobindo – US FDA classifies Telangana unit as ‘voluntary action indicated’.

- IRB Infra – December toll collection up by 26 pct at Rs. 4.88 bn vs Rs. 3.88 bn YoY.

- Fino Payments – RBI received application seeking Small Finance Bank licence.

- BEML – Gets orders from Ministry of Defence for worth of Rs. 3,298 mn.

- GMDC – Company’s Surkha mine gets Environmental Clearance for capacity expansion.

- Bajaj Finser – BAGIC gross direct premium underwritten at Rs 14.25 bn in December.

- Bharat Forge – Baba Kalyani says company revenue will hit Rs. 200 bn in 2 years.

- CESC – Arm successful bidder to set up 10,500 Tonnes/year of green hydrogen unit.

- Lemon Tree – The hotel chain signed a new hotel in Meerut, Uttar Pradesh.

Negative Read through

- ONGC, Oil – Crude sees a fall of 4 pct overnight on price cut by Saudi Arabia.

- Zee Ent – According to reports, Sony is said to plan calling off USD 10 bn Zee merger.

- Capacite Infra – To raise up to Rs. 2 bn via QIP, issue price at Rs. 251.65/share.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.