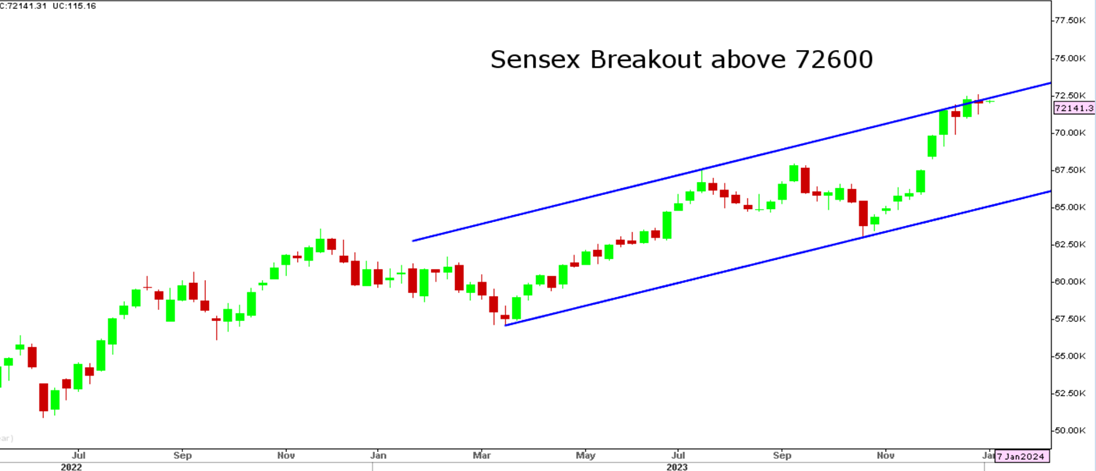

Markets for the week ended with doji star formation after prices oscillated in a narrow range to finally close in marginally negative terrain. As doji star has occurred near the resistance zone of rising channel, markets are prone for a sharp reversal in the coming days. In order for Sensex to accelerate positive momentum, Sensex needs weekly closing above 72,600. On the downside, lows of last two week which stands at 71,012 should act as a major stop loss of the entire long positions in markets. In the past few days, sharp drop in India VIX has led to trim down in hedges and has increased complacency in the system. The crucial trigger to watch would be movement in JPYINR, a rise of which could act as a catalyst for broad based selling in Indian markets.

Sensex 30 Chart

Stocks to watch

Positive Read through

- Tata Steel – Best-ever Q3 sales with sequential growth, India business deliveries at 4.88 MT.

- Bajaj Auto – Board meet to consider share buyback.

- TVS Motor – MoU with Tamil Nadu government for investment of Rs. 50 bn in 5 years.

- Godrej Cons – To deliver mid-single digit volume growth, see margin expansion YoY.

- JSW Steel – Arm gets possession of total 2,677.80 acres forest land to set up steel plant.

- ICICI Lombard – December premium up by 20 pct, Q3FY24 premium rises by 13 pct YoY.

- GMR Airports – Arbitral award in dial favour, excused from MAF during covid-19 period.

- SJVN – Signs power usage agreement with Uttarakhand Power Corp for 200 MW solar power.

- Nykaa – Q3 BPC vertical grew in mid- twenties, net sales value up 20 pct YoY.

- Sparc – Phase 3 study for Parkinson’s drug Vodobatinib begins.

- Union Bank – Q3 deposits up by 10.09 pct, advances rise by 11.44 pct YoY.

- Jupiter Wagons – Bags Rs 1,000 mn order from an automobile manufacturer.

- New India Assurance – Growth in-line with industry, December premium up by 14 pct YoY.

- Narayana Hrudayalaya – IRDAI grants license to arm to carry on Health Insurance business.

- Aurionpro – Board meet to consider fund raise via QIPs on January 10, 2024.

- REC, RVNL – Sign MoU to finance up to Rs 350 bn for infrastructure projects.

Negative Read through

- Titan – Q3 jewellery business grew by 23 pct, eyewear business declined 3 pct YoY.

- Bank of Baroda – Q3 deposits down by 0.30 pct, advances up by 2.40 pct QoQ.

- Federal Bank – RBI asks board to give 2 names for CEO position in order of preference.

- Adani Wilmar – Overall Q3 volume growth at 6 pct, sales decline at 15 pct YoY.

- Marico – Cons sales decline in low single-digits, domestic vols grew in low single-digits.

- LIC – Gets Rs 1.91 bn GST demand notice from additional commissioner, CGST, Gandhinagar.

- Star Health – Misses industry average, December premium up 15 pct YoY.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.