Markets on Tuesday recovered from day’s low and ended unchanged with back-to-back hanging man pattern in Sensex as markets enter into crucial resistance of a triangle pattern. The hanging man pattern often signifies trend reversal and can expect 50 EMA in Sensex which is placed at 65245 to act important hurdle on closing basis in near term. Meanwhile sharp decline in brent crude prices has created expectation of softening inflation in developed countries but crude still remains vulnerable to sharp upside as the war intensifies.

Result Today – Pidilite Industries, Tata power, United Spirits, Lupin, PI Industries, BHEL, Mazgaon Dock, Bata, Raymond, MTAR Tech.

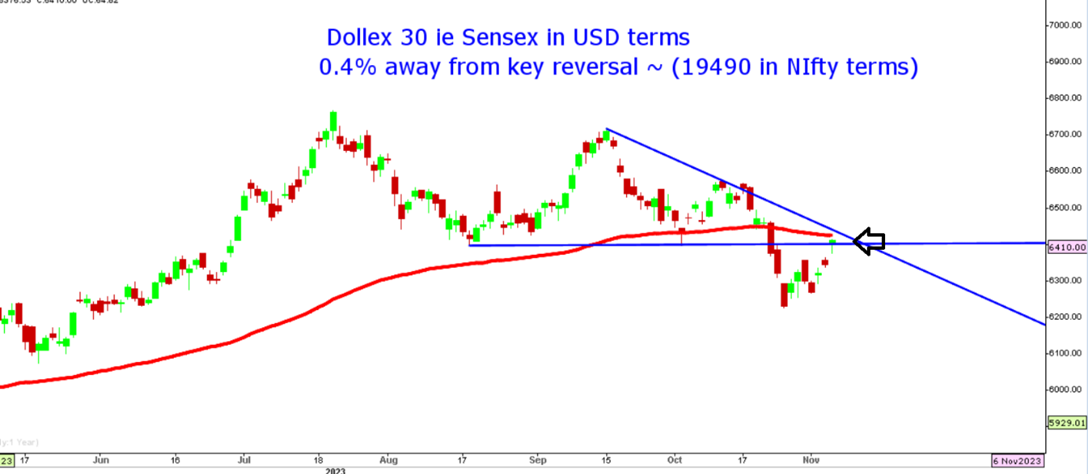

Dollex 30 in USD terms chart

Stocks to watch

Positive Read through

- Hero Moto – Agreement with partners in Europe to start EV ops in 2024.

- Hindalco – Novelis Q2 volume rise QoQ to 933 kt, EBITDA/t increased by 1 pct YoY.

- Power Grid – EBITDA increased by 5.1 pct, Margin stood at 87.9 pct vs 84.5 pct (YoY).

- IRCTC – EBITDA increased by 20.2 pct, Catering Business sales increased by 29 pct YoY.

- Apollo Tyres – Q2 above estimates, EBITDA increased by 62.9 pct YoY.

- Deepak Nitrite – EBITDA increased by 12 pct, Margin stood at 17 pct vs 13.8 YoY.

- BALRAMPUR CHINI – Gross margin increased by 1,080 bps, Sales up by 38 pct YoY.

- Cummins – Margin increased by 290 bps, Profit up by 30 pct YoY.

- Voltas – Denies of Tatas mulling home appliance business sale.

- Vinati Organics – Sales Rises 4 pct, EBITDA increased by 1.7 pct QoQ.

- Shree Cement – Sales volumes increased by 10 pct YoY, Q2 largely in-line with estimates.

- JB Chem – Margin came at 27.6 pct Vs 22.8 pct, Profit increased by 33 pct YoY.

- SJVN – UPCL intends to purchase 200 MW Power at tariff of Rs 2.57/unit fm co’s 1,000 MW Bikaner Solar Project.

- Hero MotoCorp – Company to debut in UK, key European countries with electric vehicles in 2O24.

Negative Read through

- Indigo – Expects 30-35 more aircraft to be grounded between Jan-March 2024.

- LUX Ind – EBITDA declined by 22.5 pct, Margin came at 8.7 pct vs 11.3 pct YoY.

- Srove Kraft – Profit declined by 42.9 pct, sales slips 6.5 pct YoY.

- Mishra Dhatu – EBITDA declined by 38.3 pct, Margin stood at 16 pct Vs 32.5 pct YoY

- Dredging Corp – EBITDA declined by 7.4 pct, Margin stood at 57.2 pct Vs 61.8 pct YoY.

- Dilip Buildcon – EBITDA declined by 3.2 pct, Margin stood at 12 pct Vs 13.6 pct YoY.

- Mishra Dhatu – EBITDA declined by 38.3 pct, Margin stood at 16 pct Vs 32.5 pct YoY.

- Supriya Life – Margin stood at 23 pct Vs 46 pct, EBITDA declined by 37 pct YoY.

- Rain Ind – Loss Vs Profit, EBITDA declined by 60 pct YoY.

- GSFC – EBITDA declined by 39 pct, Margin stood at 7.6 pct vs 15.7 pct YoY.

- Idea Forge – Profit of Rs 9 mn vs Rs 40 mn, sales declined by at Rs 230 mn vs Rs 400 mn YoY.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.