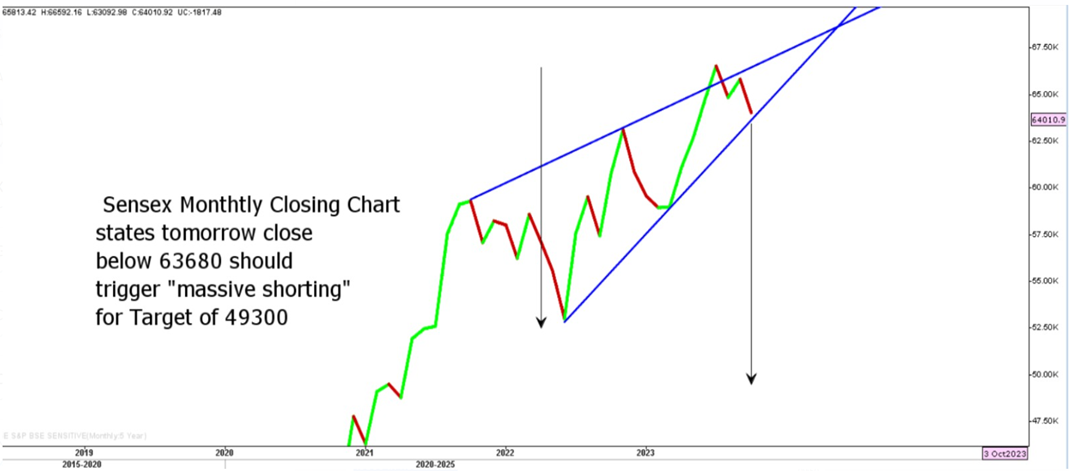

Markets for the month of October settled with losses of 1.5% after recovery seen on last Friday which helped Sensex to post monthly closing above crucial support of 63,680. The larger setup on monthly line chart still suggests caution with Sensex prone to downside risk of 21% as long it holds below 64,160. The monthly closing trend line are often followed by long-term institutional investors like Pension funds and Sovereign wealth fund managers to take important entry and exit decisions. Although it may appear like some short-term relief after Brent crude prices reacted back towards USD 85 a bbl on back U.S. intervention in international oil market but such lower levels are unlikely to sustained given ground invasion on Gaza just has begun and situation may turn worst in the next few days. From Nifty 50 spot perspective, short positions can be further added on close below 18,990.

Result Today – Ambuja Cement, Adani Wilmar, Godrej CP, Hero Moto, IGL, Sun Pharma, Tata Steel

Sensex 30

Stocks to watch

Positive Read through

- L&T – Posted Q2 above estimates on all parameters, Management optimistic on guidance & order inflow.

- Tata Cons – Q2 results above estimates, India Business sales increased by 11.3 pct YoY.

- Lupin – Receives EIR from US FDA for its manufacturing unit-2 in Mandideep.

- Aether Ind – Profit rises by 34.9 pct, Margin came at 28 pct Vs 26.3 pct YoY.

- Motherson Wiring – EBITDA rises by 37.2 pct, Margin stood at 11.8 pct Vs 9.9 pct YoY.

- CE Info – Profit rises by 29.9 pct, Sales increased 19.4 pct YoY.

- Thyrocare Tech – EBITDA increased by 18.7 pct, Margin came at 25.3 pct Vs 23.4 pct YoY.

- KEI Ind – EBITDA up by 27 pct, Margin stood at 10.5 pct Vs 10 pct YoY.

- MRPL – EBITDA up by 3.4 pct, Margin stood at 11.1 pct Vs 9.8 pct QoQ.

- Amara Raja – EBITDA rises by 12.2 pct, Margin came at 13.60 pct Vs 13.33 pct YoY.

- Adani Total Gas – EBITDA rises by 24 pct, Margin stood at 25.5 pct vs 20.3 pct YoY.

- Five Star – AUM up 44.2 pct, NII rises by 38.4 pct YoY.

- SBI Card – Company and Reliance Retail come together to roll out Reliance SBI Card.

- Aviation stocks – Jet Fuel (ATF) price cut to ₹1.11 lk/kL from ₹1.18 lk/kL in Delhi.

Negative Read through

- Bharti Airtel – Q2 below Estimates, Consolidate sales declines 1.1 pct, Profit down 17 pct QoQ.

- JSPL – Q2 results below Estimates, standalone EBITDA/t below estimates at Rs 11,164/t.

- JSW Energy – Prashant Jain steps down as Joint MD & CEO of Company w.e.f. Jan 31, 2024.

- Mankind – Margin came Flat QoQ, Sales increased 11.6 pct YoY.

- DCB Bank – Asset quality deteriorates, NIM declines for 2nd straight Quarter.

- Dhampur Sugar – EBITDA down by 28.8 pct, Margin came at 4.8 pct vs 5.7 pct YoY

- Kaynes Tech – Gross margin contracts 2.0 pct YoY, EBITDA margin below Estimates.

- Star Health – Net premium earned up 15 pct, combined ratio rises 130 bps YoY.

- Navin Flourine – EBITDA margin lowest in 18 Quarters, Q2 below estimates.

- Rites – Profit of Rs 1160 mn vs Rs 1310 mn, sales down at Rs 5490 mn vs Rs 6320 mn YoY.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.