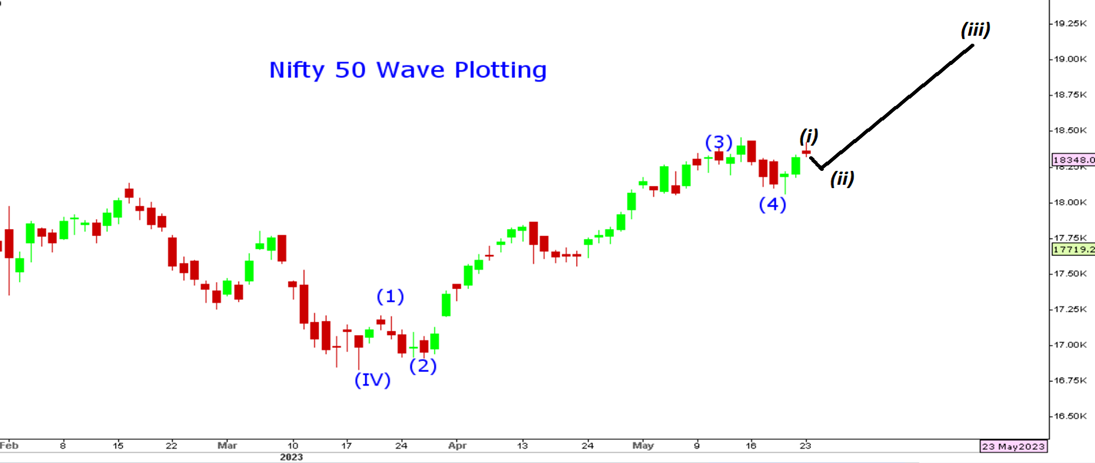

Markets reacted lower amid worries over U.S. debt ceiling deal with banking stocks dragging Nifty lower by 0.3%. The Wave (ii) within Wave (5) seems to be in progress and expected to settle in range of 18230-18285. With advance decline ratio remaining in the positive terrain despite selling in large cap stocks. We expect current correction to be short lived before we see a near term upside towards 19220.

Nifty 50

Stocks to watch

Positive Read through

- Gujarat Gas to cut industrial gas prices to Rs 38.43 per scm from June 1 according to reports

- LIC- VNB margin at 19.4 pct vs 14.6 pct QoQ, FY23 APE up 12.5 pct YoY

- Nalco- Q4 results above estimates, aluminum business EBIT up 44.7 pct QoQ

- Piramal Pharma- reports highest margin and revenue since Q4FY22

- Titagarh Wagons- reports Rs 48 cr profit vs loss, freight rail EBIT up 81 pct YoY

- Nykaa- EBIDTA clims 83.2 pct, margin expands more than 100 bps YoY

- Borosil Renewables- EBIDTA up 85 pct, margin rises 350 bps QoQ

- Gujarat Pipavav- EBIDTA up 1.6 pct, net profit rises 30.8 pct YoY

- Fine Organics- EBITDA rises 26.5 pct, margin at 34 pct vs 21.2 pct YoY

- Pheonix Mills- EBIDTA rises 27 pct, margin up 1000 bps YoY

- BL Kashyap – bags an order worth Rs 132 cr

- Wonderla Holidays- Margin at 43 pct vs 34.4 pct, revenue up 69.7 pct YoY

Negative Read through

- Oil India- EBIDTA down 17.7 pct, margin at 43.6 pct vs 53.1 pct QoQ

- JB Chem- Q4 results below street estimates, margin at 21.5 pct vs 20 pct YoY

- Garden Reach- EBIDTA down 37.4 pct, margin at 3.4 pct 6 pct YoY

- Ashoka Buildcom- EBIDTA down 2 pct, margin at 22.7 pct vs 28.5 pct YoY

- Shyam Metalics- EBIDTA slips 37.6 pct, margin at 12.2 pct vs 23.2 pct YoY

- Trident- EBIDTA down 20.5 pct, margin at 17.1 pct vs 18.1 pct YoY

- Asian Granito- Net loss Rs 44.7 cr vs profit, Revenue slips 5 pct YoY

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.