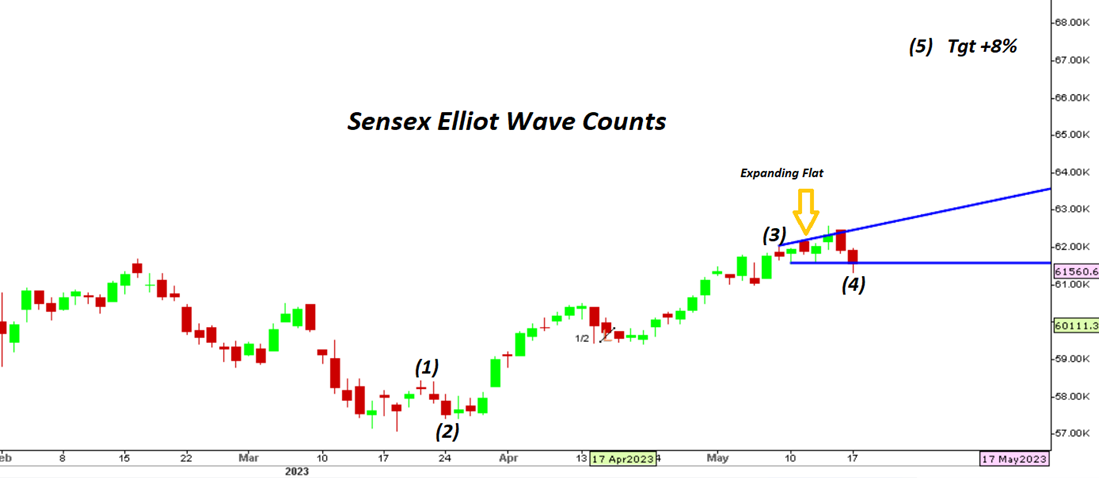

Markets cooled off from highs to end in the negative terrain on the back of concerns related to the U.S. debt ceiling which forced Nifty to breach 18200 levels. After yesterday’s decline, we can clearly see the formation of Wave 4 correction in the form of expanding flat and this would mean we may see follow-up buying in the form of Wave 5 with a potential upside of 8% from current levels. Overall view on the market remains positive and any gap-up opening should provide necessary confirmation of the start of Wave 5.

Sensex

Stocks to watch

Positive Read through

- JSW Steel- Preferred Bidder for Composite Licence of An Iron Ore Mine

- Jindal Stainless-India Biz Volumes, Calculated EBITDA/t Rise QoQ

- NHPC, Gets LoI from Guj Govt for a Proj Worth Approx ‘1,008 Cr

- Thermax- EBITDA Up 48%, Margin Expands Nearly 200 bps YoY

- JK Tyre-EBITDA Up 65%, Margin Expands 350 bps YoY

- Restaurant Brands- India business revenue is up 35.8 pct, India SSSg at 8.3 pct

- MTAR Tech – revenue up 99.3 pct, net profit rises 56.6 pct YoY.

- Honeywell Auto- EBIDTA rises 59 pct, margin up more than 300 bps YoY.

- Lemon Tree- Signs license agreement for an 82-room property in Lucknow

- Sheela Foam- EBIDTA up 7.8 pct, margin at 10.5 pct vs 9.8 pct Yoy

Negative Read through

- Whirlpool- EBITDA down 28 pct, margin at 6.3 pct vs 8.6 pct YoY.

- REC- NIM lowest in 20 qtrs at 3.29 pct, NII down 12.2 pct YoY.

- Railtel- margin at 14 pct vs 20.7 pct, EBITDA up 2 pct YoY

- Vedant Fashion- Promoter to sell up to 7 pct via OFS, floor price Rs 1161 a sh

- GSK Pharma- EBITDA down 26 pct, margin at 22 pct vs 28.5 pct QoQ

- Pricol- filed an application with CCI against Minda’s application to buy up to 24.5 pct equity

- Sanghi Inds- net loss Rs 104.6 cr vs profit of Rs 6.3 cr YoY

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.