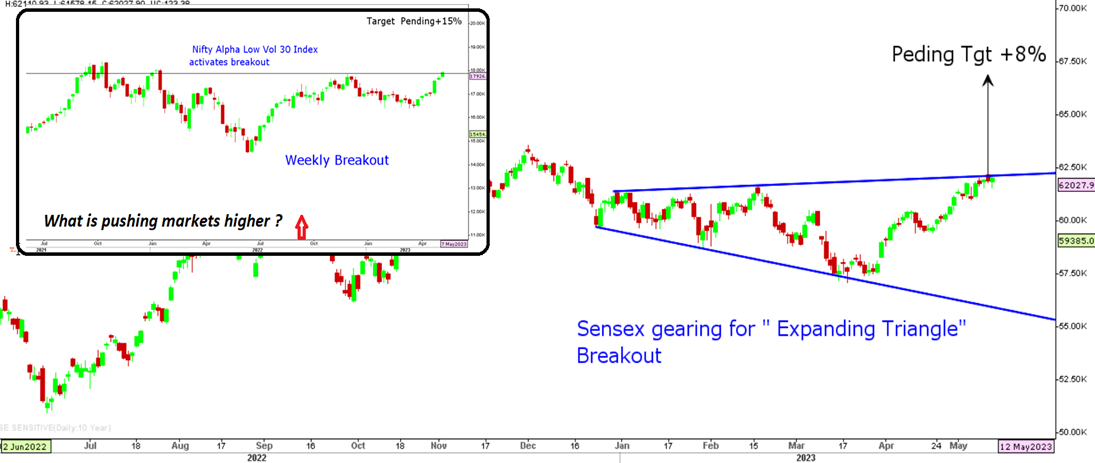

Markets advanced further on Monday to end with gains of 0.5% but failed to close above 18400 during last hour of selling from highs. After yesterday’s upmove, Sensex has confirmed breakout from expanding triangle which opens gates for further rise of 8% in the near term. Most market participants are watching 18500 as a psychological hurdle and hence are resorting to aggressive hedging. However, given the recent strength in broader markets, we expect major short covering on a move above 18450 for a weekly target of 19000.

Sensex & Nifty Alpha Low Vol 30 Index

Stocks to watch

Positive Read through

- UltraTech Cement- Subsidiary UltraTech Nathdwara Cement has commissioned 0.8 mtpa brownfield cement capacity at Rajasthan.

- Astral-EBITDA Up 42.5%, Margin Rises Nearly 500 Points

- HCL Tech announced the expansion of its long-standing partnership with SAP to drive digital transformation for enterprises.

- ONGC, OIL- windfall tax on crude petroleum reduced to Nil from Rs 4100 a ton.

- Berger Paints- EBIDTA up 6.4 pct, gross margin expands 90 bps YoY.

- PVR- revenue, EBIDTA above estimates, PVR-Inox ops revenue up 34 pct YoY.

- PCBL- EBITDA Up 36%, Margin Rises 240 bps YoY

- Home First Fin- Norges Bank& Societe Generale Buyer in Block Deals

- Pfizer- EBITDA Up 10% Margin Expands 180 Points YoY

- Vesuvius- Q1CY23 EBITDA Up 65% Margin Up More Than 400 bps YoY

- Uttam Sugar- Revenue Up 7.5%, Net Profit Expands 14.6% YoY

- Suryoday SFB- Deposits Up 34.2% NIM At 10.4% vs 7.8%(YoY)

Negative Read through

- Coromandel Intl- Profit Down 15%, Margin Contracts Nearly 200 bps YoY

- P&G Health- Q3 EBITDA Down 27%, Margin At 24.8% Vs 35.1% (QOQ)

- EMKAY GLOBAL- Revenue Down 0.7%, Net Loss At Rs 3.7 cr

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.