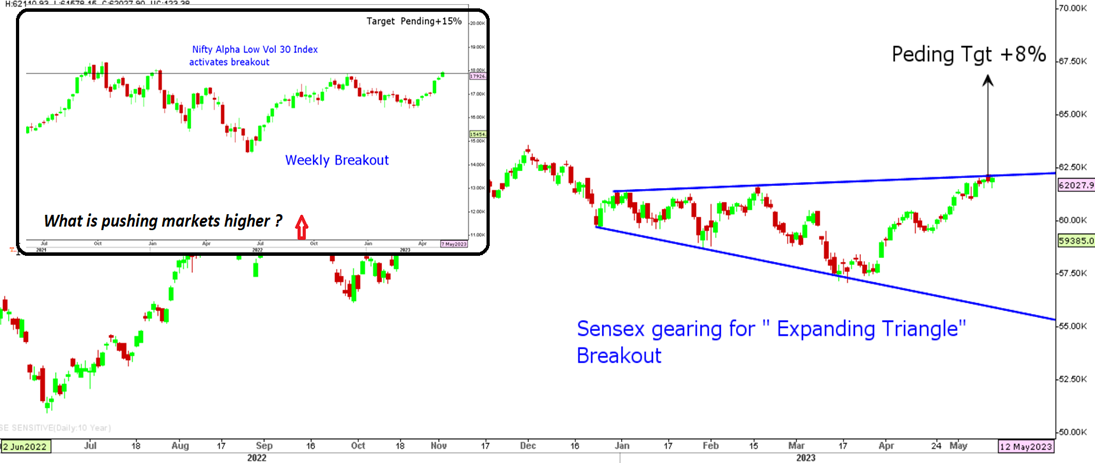

Markets managed to post weekly gains of less than 2% despite exit polls turning against BJP and were followed by Nifty closing above 18300. We expect the Nifty 50 to gain further momentum as the Nifty Alpha Low Vol 30 index crosses above December 2022 highs and thus opening gates for another 15% upside. For Nifty, any lower opening is likely to see follow-up buying with a weekly target placed at 19000 as we head closer to G20 meet in Kashmir.

Sensex & Nifty Alpha Low Vol 30 Index

Stocks to watch

Positive Read through

- Hero Moto has announced a partnership with Motorsport SA in Costa Rica to boost its presence in Central America.

- Adani Transmission board has approved the raising of funds up to Rs 8,500 crore through QIP.

- Tata Motors CV business margin at 17-atr high, net debt down QoQ.

- Colgate Q4 results largely in-line, EBIDTA rises 5.2 pct YoY.

- Manappuram Fin- Q4 above estimates, VP Nandakumar gets interim stay order from HC.

- Navin Fluorine Q4 margin at 28.9 pct vs 23 pct, revenue up 70 pct YoY.

- Ami Organics- EBIDTA rises 59.1 pct, margin up 400 bps YoY.

- DLF Q4 collections at 1929 cr vs Rs 1398 cr QoQ, net debt declines

- HPCL- margin rises 330 bps QoQ, GRM above estimate at USD 14.1 per bbl

- RVNL- JV bags order worth Rs 2250 cr for an irrigation project in Rajasthan

- Advanced Enzymes- EBIDTA rises 10 pct, margin up over 100 bps YoY

- Krsnaa Diagnostics- lowest bidder for a tender issued by the Rajasthan govt

- Rainbow Medi- Margin rises 700 bps, revenue up 47 pct YoY

Negative Read through

- APL Apollo- Q4 EBIDTA per tonne at Rs 4970, margin up 100 bps YoY.

- IGL- Q4 volumes below estimates at 8.3 mmscmd, revenue flat QoQ

- Max Financial- VNB margin at 30.3 pct vs 31.9 pct, total APE up 38 pct YoY

- Avenue Supermart- margin misses estimates, gross margin down 100 bps YoY

- Sonata Software- EBIT contracts 7 pct, revenue down 15.4 pct QoQ

- Laxmi Organics- revenue down 16.7 pct, net profit slips 65.2 pct YoY

- Affle- margin slips 200 bps, revenue is down 5 pct QoQ

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or its communication cannot be held responsible for it.