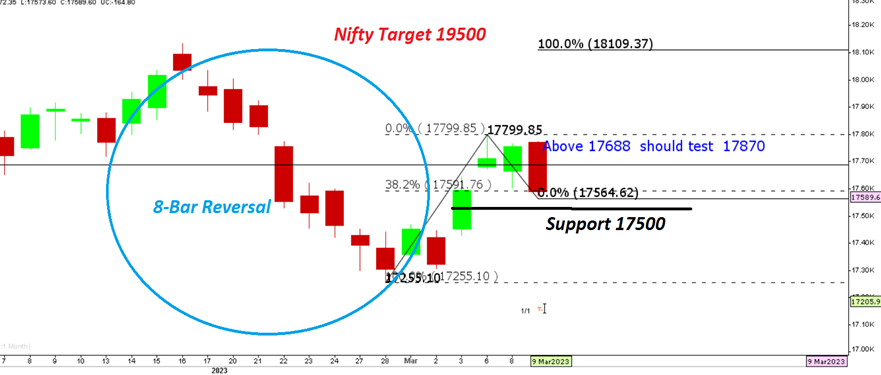

Markets declined on low volumes on Thursday taking cues from the global market amidst worries of a 50 bps rate hike in the upcoming Fed policy on 22 March. The decline forced prices to retrace around 38.2% of the recent up move which is seen as a strong support and reversal zone. The immediate upside based on weekly closing is expected around 17870 based on the bullish weekly candle in the previous week.

In short term, there has been ‘Round Number’ resistance which has come to around 17,799.85 above which the market may trigger major short covering towards 18,109 in the coming days. Overall view on the market remains bullish as we feel that Nifty is unlikely to breach below the recent low of 17,255.

Nifty 50

Stocks to watch

Positive Read through

- Tata Motors unit Tata Technologies files DRHP with SEBI for IPO.

- Jubilant Food- Sameer Batra joins the Company as President and Chief Business Officer.

- Arvind, Welspun India- Among 13 suitors to acquire Bombay Rayon Fashions.

- Max Healthcare, KKR in separate talks with TPG to acquire CARE Hospitals.

- Bank of Baroda- approves divestment of 49 pct stake in BOB Fin Solutions.

- Zydus Life- Final USFDA nod for Erythromycin tablets.

- Wipro- Menzies Aviation selects Co to transform its air cargo services.

- IRB Infra- Feb toll collections are up 26.7 pct YoY, down 6.2 pct MoM.

- IRB InvIT- Feb toll collection up 2 pct MoM and 13 pct YoY.

- Natco- Co and Teva launch additional dosage strengths of Revlimid generic.

- Krsnaa Diagnostic- operationalizes 100 more pathology collection centers.

- PNC Infra- lowest bidder for two NHAI projects worth Rs 2000 cr.

- NBCC- Rs 230 cr order for construction of a new campus for IIFT.

Negative Read through

- Gokaldas Exports- AB Sun Life, Ashoka India, and GS Funds buy shares in block deals.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.