Markets ended mixed on Thursday with Nifty ending with marginal losses while Sensex ended in the green above 59,000. The broader market remained buoyant while Adani Group shares saw extended selling pressure. For the Nifty 50, the outlook remains highly cautious with an immediate decline expected to break below the psychological support of 17000 in the coming days.

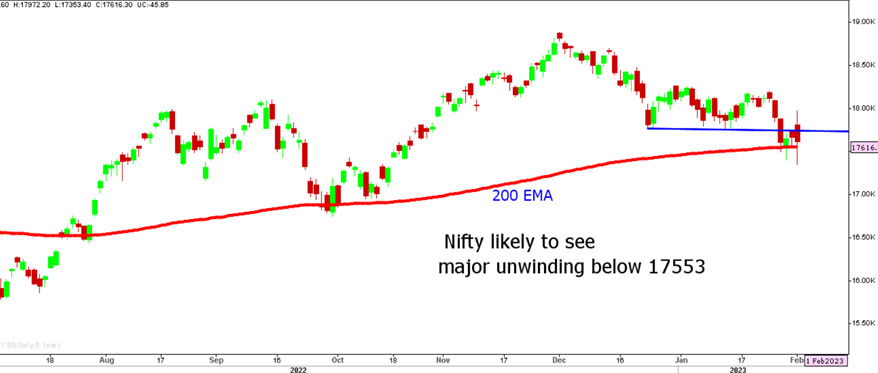

The Rupee may enter turbulence times after USDINR closes firmly above 82 levels with a potential target of 85. We expect selling to intensify on closing below 17,553 in Nifty terms.

Nifty 50 index

Stocks to watch

Positive Read through

- Tata Consumer- Q3 earnings in line with estimates, one-time gain boosts profit.

- SBI Life- Taxable premium announced in Budget forms less than 2 pct of 9mFY23 APE.

- IndusInd Bank- reports say promoters plan to raise stake up to 26 pct from 16.5 pct.

- Apollo Tyres- EBIDTA up 23 pct, margin up 120 bps YoY.

- AB Capital- lending business NIM at 7 pct vs 6.58 pct, profit up 9 pct QoQ.

- MGL- Q3 results largely in line with estimates, revenue up 7 pct QoQ.

- Welspun Corp- EBIDTA up 50.5 pct, revenue up 66.6 pct YoY.

- GMM Pfaudler- EBIDTA up 43.7 pct, margin rises more than 200 bps.

- Karnataka Bank- NIM at an all-time high, Gross NPA ratio best in 5 years.

Negative Read through

- Adani Group- Stocks in ASM, Adani Enterprise to be removed from DJ sustainability indices.

- Berger Paints- EBITDA down 11 pct, Gross and EBITDA margin decline YoY and QoQ.

- HDFC AMC- SEBI approves sale of abrdn’s entire 10.21 pct stake.

- Crompton Cons- Q3 results below estimates, margin down 430 bps YoY.

- Sheela Foam- EBITDA down 21.6 pct, margin slips 160 bps YoY.

- SH Kelkar- EBITDA down 26.9 pct, margin slips 360 bps YoY.

- GIC Housing Finance- Net profit down 14.5 pct, NII down 14.1 pct YoY.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.