Markets witnessed major selling pressure on Wednesday with most of the key indices declining around 1% ahead of Fed minutes despite global equities turning unchanged. The Fed minutes stated that Fed officials’ intent on lowering inflation back towards their 2% target is at risk of rising unemployment and slow growth.

The FIIs suddenly dumped around Rs 7300 crores (Cash + Futures) after dull activity in the past few days as DIIs attempted to hold the markets in mid-afternoon. We expect heavy selling pressure to open in Nifty and the U.S. market in the days to come with an expectation of a hawkish stance of the U.S. Fed.

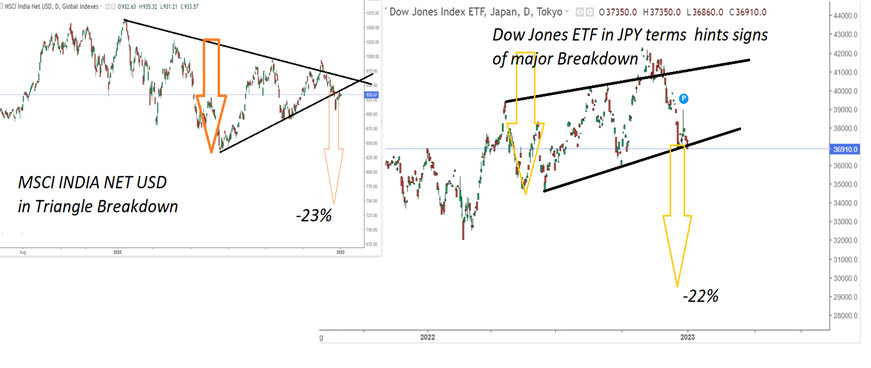

Dow Jones in JPY & MSCI India Net USD

Stocks to watch

Positive Read through

- HUL has completed the acquisition of 19.8% shareholdings of Nutritionalab, for Rs 70 crore.

- IRB Infra has received the board approval for sub-division to 10 equity shares of Re 1 each.

- HPCL has forayed into petrochemical buz with pre-marketing of the HP Durapol brand of polymers.

- Bajaj Finance records the highest ever quarterly increase in customer franchise for Dec qtr.

- Adani ports container volume rises 8% as the Co handled 25.1 mt of cargo in Dec.

- RBL Bank deposits rise 11% at Rs 81,746 cr, while advances come in at Rs 68,371 cr.

Negative Read through

- NDTV- Investor LTS Investment Fund has further offloaded a 2.38% stake in Co via the open market.

- Marico- Consol revenue in Q3FY23 grew in the low single digits on a YoY basis.

- Bharat Forge- Dec Class Truck orders are down from Sept high of 56,500 units.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the investor’s sole decision, and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.