Equity markets fell during the week as higher than expected inflation in the U.S increased the chances of aggressive rate hikes from the U.S Federal Reserve at its upcoming policy meet. Core CPI for August was 6.3% YoY vs an expectation of 6.1% YoY and a prior reading of 5.9% YoY. This sent expectations of a 100-bps rate increase at the upcoming policy meet.

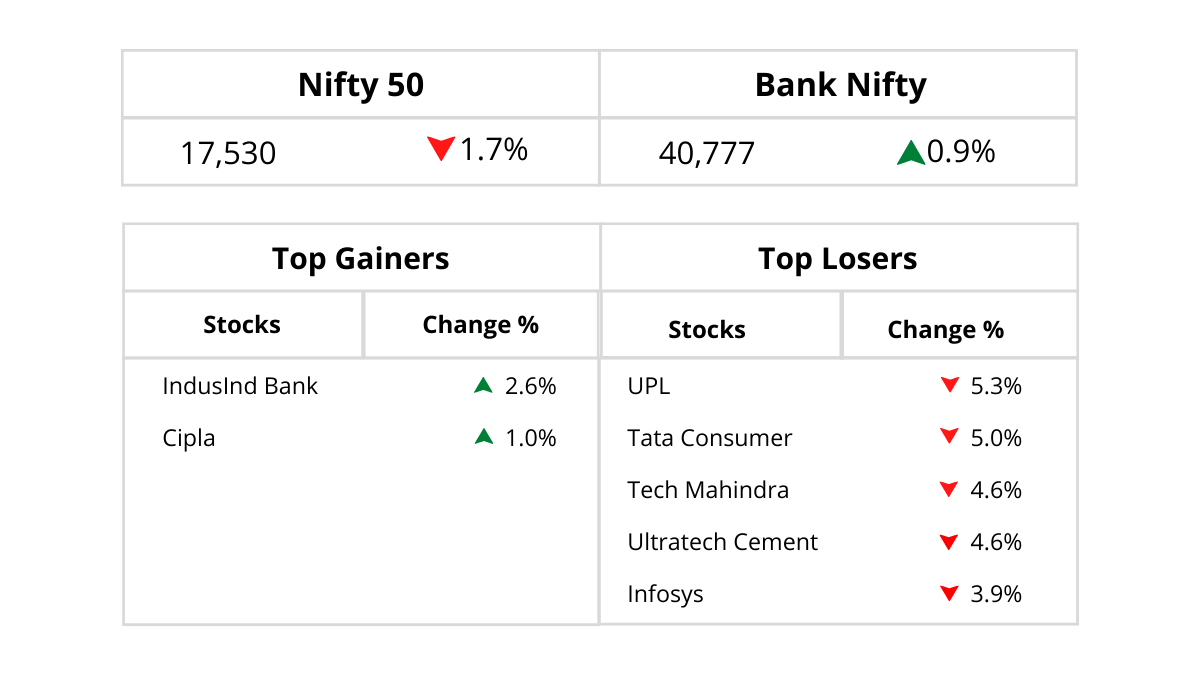

The Nifty ended lower by 1.7% for the week to 17,530 levels while the Nifty Midcap and Nifty Smallcap index fell by 1.7% and 1.2% each. The nifty Metal index gained 1.9% and Nifty Bank gained 0.9%, both outperforming the broader indices.

Nifty IT was down 7% and was the top sectoral loser. FIIs were net sellers to the tune of Rs 19.22 bn and DIIs were net sellers to the tune of Rs 29.35 bn during the week.

Stock And Sector Specific Update

IT Sector

India IT sector stocks fell after a sharp decline in Nasdaq with Infosys down by 9%, Tech Mahindra down by 8%, and TCS & HCL Tech falling by about 6% each. On a year-to-date basis, the Nifty IT index has underperformed by a wide margin and is down 31%.

However, commentary from listed IT suggests that there is a steady demand trend with a healthy pipeline and strong (relative) near-term growth outlook, and some slowdown is seen in the retail vertical but a strong growth outlook remains in the BFSI vertical.

Vedanta gained 9% for the week after it announced that the Company and electronics manufacturing giant Foxconn has signed an MoU with the Gujarat government to set up a semiconductor and display FAB manufacturing unit in the state.

However, the stock was corrected and gave away some of the gains after it clarified that its “ultimate holding company” Volcan Investments would undertake the business of manufacturing semiconductors and not Vedanta as was reported in sections of the media.

Defence

Shares of defence and its related companies traded higher on the back of a strong business outlook. Garden Reach Shipbuilders & Engineers and Bharat Dynamics have surged up to 13%. With the government’s focus on defence sector, there is a gradual shift towards increasing indigenization across the army, navy, and air force.

On the one hand, this shift translates to a reduction of defense imports and a rise in domestic absorption of indigenous products, it also helps the country increase its defense export. The Government of India has identified the aerospace & defense sector as a focus area under its Aatmanirbhar Bharat or self-reliant India initiative.

The government’s vision is to achieve a turnover of USD 25 bn, including export of USD 5 bn in the aerospace & defense goods and services sector by 2025. India is the 3rd largest military spender in the world, with its defense budget accounting for 2.15% of the country’s total GDP. Over the next 5-7 years, the Government of India plans to spend USD 130 bn for fleet modernization across all armed services.

We remain positive on the sector with our top picks being Bharat Dynamics, Hindustan Aeronautics, Bharat Electronics, GRSE, and Mazagon Dock Shipbuilders.

Automobile

Society of Indian Automobile Manufacturers (SIAM) in its latest data has shown that automobile sales in India jumped by 17% YoY in August 2022 led by healthy growth in passenger vehicle sales of 21%. Overall automobile sales rose to 18,77,072 units in August 2022 as against 15,94,573 units sold in August 2021. Total 2-wheelers sales rose to 15,57,429 units in August 2022, registering YoY growth of 16.33% over 13,38,740 units sold in August 2021.

Cement And Telecom

Cement stocks gained sharply on the overall positive outlook in the sector, as well as the Ambuja Cements fundraising plan announcement. Telecom companies’ stocks remained on watch with reports that telecom and satellite operators should look at using the same spectrum bands in coordination with each other and the decision on the use of high-frequency range for broadband is likely to be taken in 4-5 months.

PM Modi has unveiled the National Logistics Policy that seeks to address challenges facing the transport sector and bring down the logistics cost of businesses from 13-14% to a single digit. The draft policy provides for the government creating a single point of reference for all logistics and trade facilitation matters, reducing costs for the logistics sector to 10 percent in five years.

Market Outlook For Coming Week

For the coming week, markets are expected to remain volatile as the US Fed will announce its interest rate decision on 20-21 September. Markets expect the Fed to increase rates by 75-100 bps. The Bank of Japan (BoJ) too will decide on the interest rate on Thursday, 22 September. FII flows will be watched closely as they have turned into net sellers in the past three trading sessions after turning buyers recently.

The last two days of decline may have triggered a shake-out in the Nifty index but the ultimate trend still remains with a positive bias with an immediate upside seen at 18600. There has been sectoral diversion visible in Indian markets with Nifty IT index which holds 15% weight in Nifty 50 Index hitting almost 52 weeks low while Bank Nifty holding significant weightage in Index saw hitting an all-time high.

With major support emerging at 17,250 in Nifty, we expect Indian markets to see follow-up buying around 17,400 and expect a smart recovery in the coming days.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.