Markets rebounded from lows to end in positive terrain with Nifty closing above 17,600 but breadth of market remained negative. The September series VWAP for Nifty is placed at 17666 above which, bulls will gather steam to re-test its all-time high.

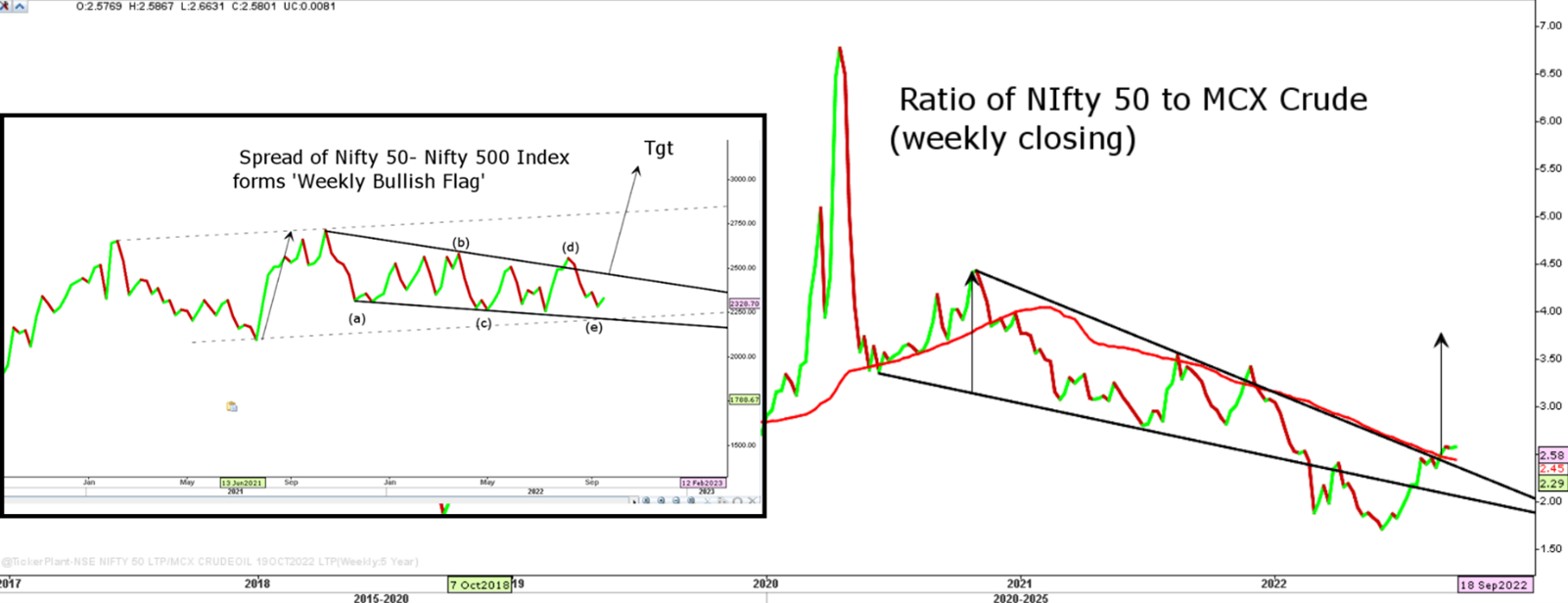

The main trigger for outperformance of Indian market against its global peers likely to come from breakout in ratio of Nifty 50 to MCX WTI Crude which may divert significant fund flows from Oil based hedge funds to Nifty 50 basket paving way for lifetime highs.

The current rise in spread of Nifty 50- Nifty 500 index would also ensure broader market underperformance with gains restricted to Nifty 50 stocks. Overall, outlook remains highly positive with major support seen at 17480 in Nifty Index.

Ratio of Nifty 50 to MCX Crude & Spread of Nifty 50- Nifty 500 Index

Stocks to watch

Positive Read through

- Inox Green Energy plans to launch Rs 740-cr IPO in next 30-45 days.

- Vedanta’s Rs 1.54 lakh crore semiconductor plans won’t chip away at liquidity.

- CCI approves merger of Jio Cinema OTT with Viacom18 Media.

- IRCTC set to enter payments sector, eyes aggregator license from RBI.

- PFC eyes new infra, net zero value chain: Chairman & MD R S Dhillon.

- YES Bank to sell all its NPAs to JC Flowers ARC by December.

- Adani Green commissions 325-MW wind power project in Madhya Pradesh.

- Lupin launches generic Suprep Bowel Prep Kit in United States.

- Natco- gets CTPR launch approval from Delhi High Court.

Negative Read through

- Can Fin Homes’ MD & CEO Girish Kousgi resigns.

- Butterfly Gandhimati- CG announces OFS for Co at floor price of Rs 1370 a share.

- KIMS- General Atlantic sells further stake, ICICI Pri is a buyer

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 1499/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.

Related Posts

Stay up-to-date with the latest information.