Markets declined over 5% last week after U.S. Fed hiked key rates by 75 bps and hinted 50 bps rate hike in the month of July. The main draggers for markets were metals and technology sectors which have convincingly broken March 2022 lows while Bank Nifty was still able to sustain above March 2022 lows.

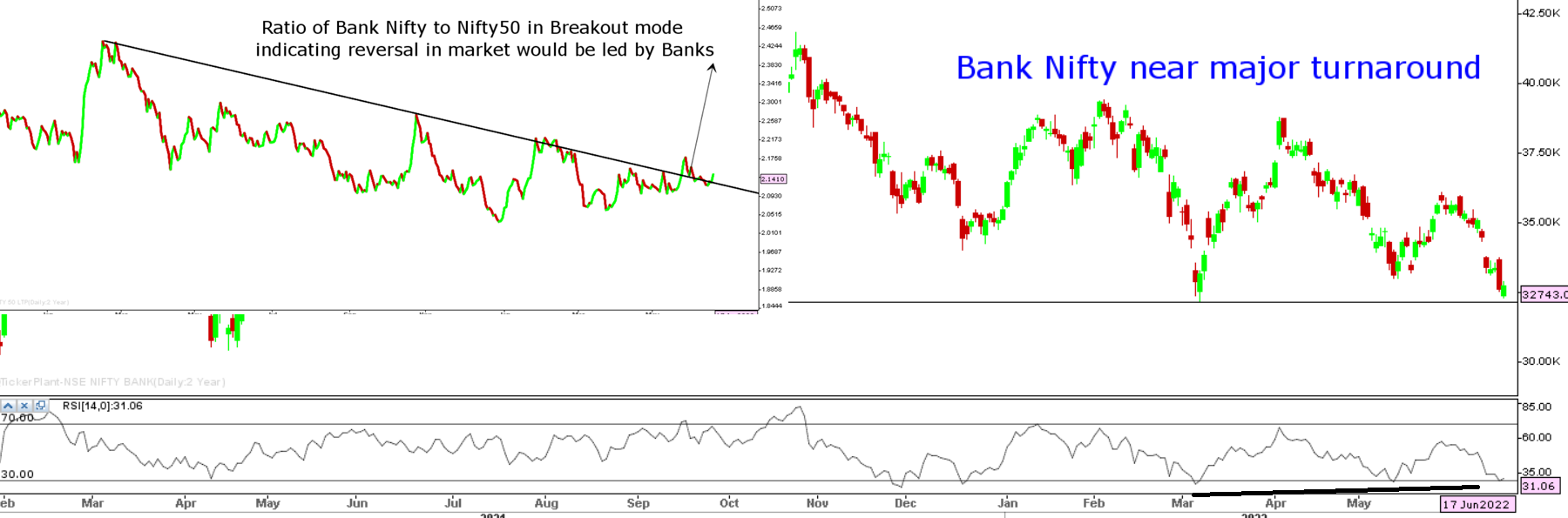

With the prevalence of RSI positive divergence for both Nifty and Bank Nifty, markets remain poised for a major turnaround. But this could only materialize provided Brent crude moves below USD 110 a bbl and Nifty regains its control above 15715. There is also a breakout seen in the ratio of Bank Nifty to Nifty 50 index indicating that fund flows are diverting to the banking sector in the coming days.

We expect the market to open on a soft note on account of the weak opening in the Asian markets that have suffered a triple blow of recession fears in the US, inflationary pressure, and the Fed’s rate hike.

People’s Bank of China kept an unchanged interest rate today.

Bank Nifty & Ratio of Bank Nifty to Nifty 50 Index.

Stocks to watch

Positive Read Through

- Aurobindo Pharma has agreed to acquire a 51% equity shares in Indian oncology-focused pharmaceutical company GLS Pharma for Rs28cr

- Vodafone Idea to consider a proposal for raising of funds aggregating up to Rs. 500 crores.

- Cipla buys a 21.05% stake in Achira Labs Pvt into medical test kits in India for Rs 25 crore

- Adani Wilmar Co has reduced prices of its edible oils by at least Rs 10 a liter after the govt reduced import duty on the commodity.

- PVR Cinemas announced the opening of its first multiplex at VRC City Mall in Patiala, Punjab

- Vedanta seeks to sell its copper plant in Tuticorin, Tamil Nadu.

- Coverage partners with US-based Estes Express Lines for transportation and logistics Ind solutions.

Negative Read Through

- ONGC, OIL- Brent crude down nearly 7% in the last week

- Alkem- gets 3 observations for the US facility at St. Louis

- Shree Cement- approves expansion plans in Guntur, Andra Pradesh

- Delta Corp- Rakesh Jhunjhunwala sells 57.5 lk shares on Friday in a large trade

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs. 99/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.