The Indian rupee has fallen to record lows amid the worsening risk sentiment and the continued spree of overseas outflows from domestic equities.

The rupee fell to an all-time low of 77.6125 against the U.S. Dollar due to sell-off inequities.

A major reason for sell-off inequities

- Hike in interest rates by the U.S. Federal Reserve.

- Weakening global economic growth prospects.

- Growth concerns in China due to the COVID-19 surge

- supply disruption due to Covid-19 lockdown and

- the war between Russia and Ukraine

These factors have increased fears about how growth will hold up around the globe

- Further tightening of monetary policy by central banks to counter rising inflation.

- Persistent FIIs outflows – India has witnessed an FII outflow of Rs. 1,95,000 crores so far this year. Foreign funds had pulled out Rs.92,700 crore last year CY21

- An unabated rise in the dollar index towards a two-decade high, soaring U.S. treasury yields, and crude prices, all of them have worked their way to push the domestic currency on a downward trajectory

- The outflow of dollar – Continuous high crude prices is causing the outflow of dollars.

How will it impact India?

As we import almost 80% of our crude and crude prices are not coming down at all, thus falling rupee makes us a little more vulnerable compared to other Asian economies.

It is putting pressure on our current account deficit and that clearly is a sign of an economy that is not doing particularly well on the external front.

It is worrisome as this would also increase the trade deficit resulting in an expected current account deficit of 3 percent and impacting the balance of payments.

How it will impact your life

The biggest impact is on inflation which is already high. In April, inflation jumps to 8- a year high of 7.79%. At a time when inflation is already so high, any further depreciation in the rupee is going to hit us primarily through the inflation route only.

Imports: With the dip in Rupee, importing items will get more expensive. Oil imports will get costlier, which can directly impact consumers.

Loans – To control inflation, RBI increases the repo rate, which makes borrowing expensive. We have already seen this start happening.

Stocks: Rupee depreciation is also the effect of foreign investors pulling out of Indian equities. This means that there could be a sharp fall in equity markets, resulting in a decline in stock and equity mutual funds investments.

Foreign Education and foreign travel will become more expensive

What can RBI do?

RBI can only try and smoothen the decline and fortunately for us, we have forex reserves. though the reserves have also fallen to less than $600 billion. There is nothing much that the RBI can do except ensure that the spikes are not very sharp. So, as of now, there is no need to panic but there is definitely a need for us to be concerned because there is a global risk-off and we have been behind the curve as far as inflation is concerned.

Expectations

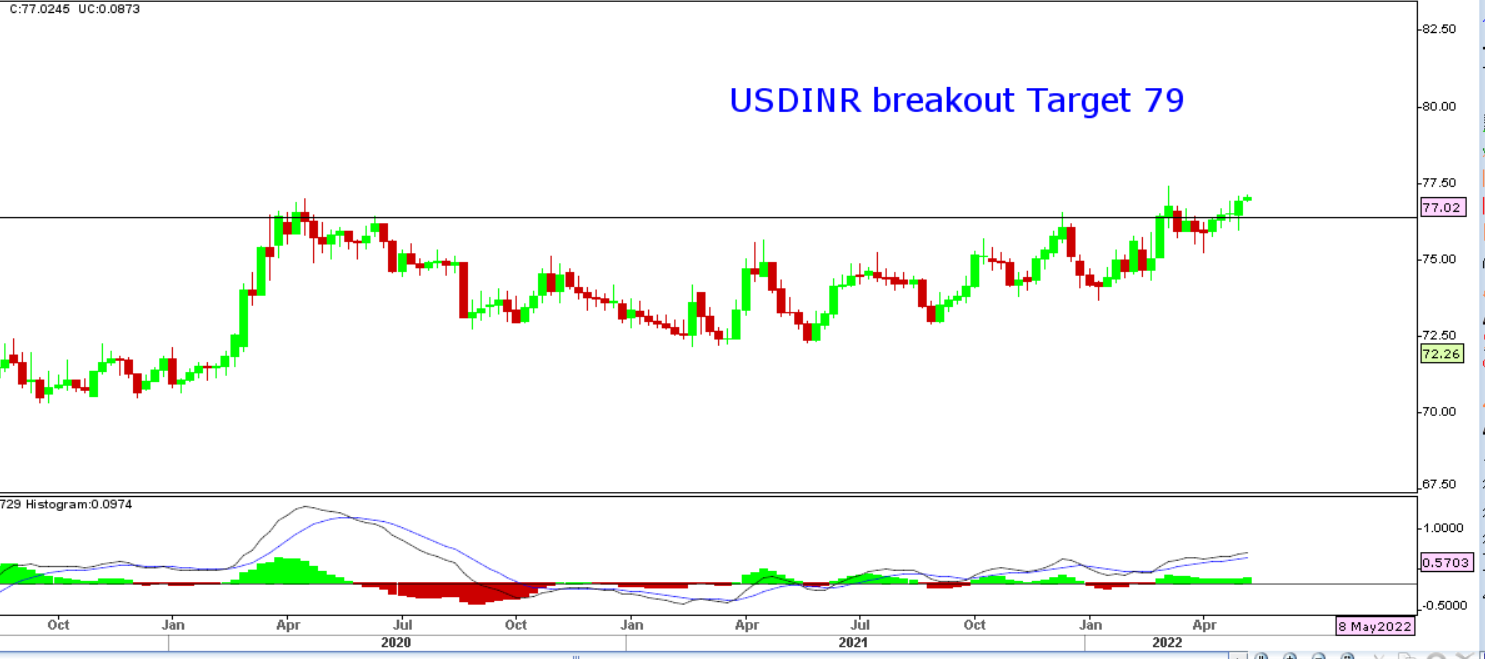

With USDINR comfortably above the 76.5 mark, we expect an immediate move towards 79 in the next few days. We expect equity markets to stabilize after USDINR completes its intermediate target of 79, until then high volatility in equity markets may persist.

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs99/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app.

Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.