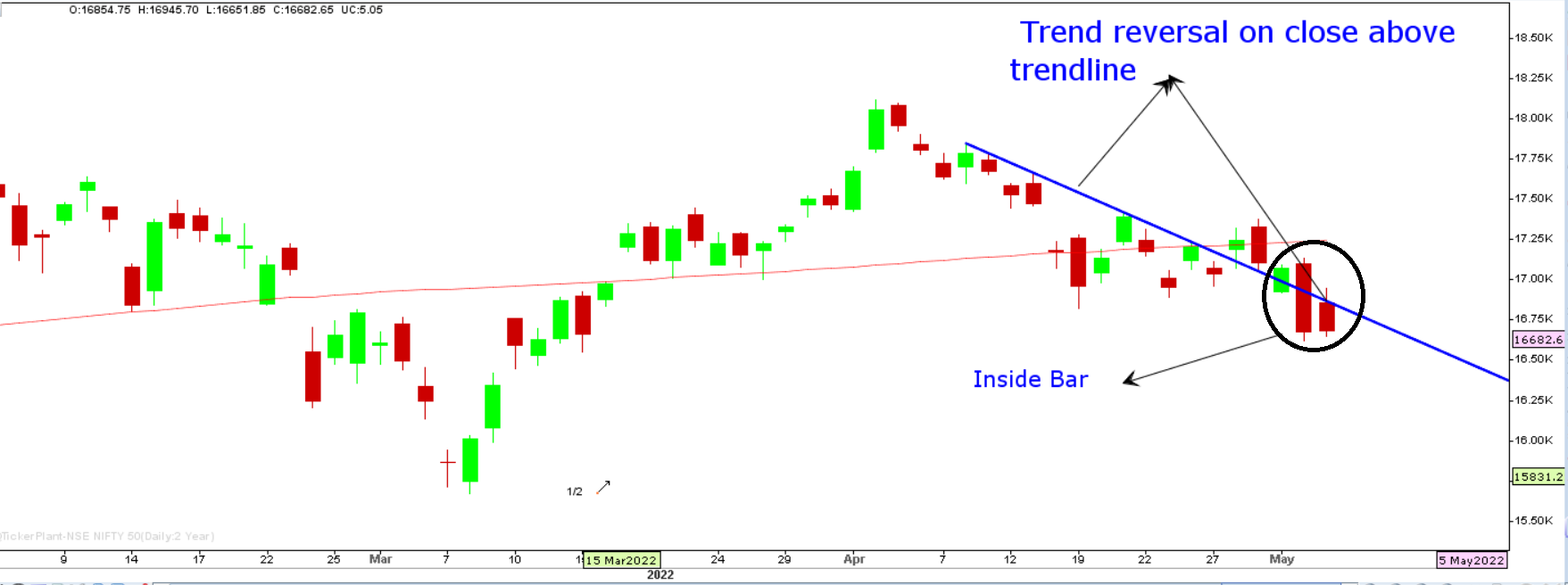

Markets cooled off from day’s high to end on a flat note yesterday forming an inside bar pattern on a daily candlestick chart.

An inside bar often occurs ahead of the intermediate bottom hence we can expect a major turnaround in the market in the next 2-to 3 sessions. The India VIX also cooled from the resistance of 22% mark to end with losses of 8%.

For the market to see a sustainable rally, the India VIX should be trading below 18% else gains are short-lived. In Nifty terms, 16671 still remains critical support on a closing basis, and in case the market sees a violation of the same, the next ideal support for the turnaround of this correction phase is seen at 16123.

Expects the market to open on a weak note on account of across the global markets selling over concerns about the Federal Reserve’s tightening campaign to tame surging inflation and traders raised their bets of a 75-basis-point rise in June, even though Powell ruled that out.

Nifty 50 Index

Stocks to watch

Positive Read Through

- Tata Power secured India’s largest single solar EPC order of 1 Giga Watt for approximately Rs 5,500 crore from SJVN.

- Infosys Modernization Radar 2022: Half of Enterprise Legacy Applications to be Modernized in the Next Two Years

- HFCL – Wipro and HFCL announce 5G Product Development Partnership

- Mahindra Group is likely to split its auto business into 3 units – EV, tractor, and PV businesses into three independent companies via a demerger process.

- TVS Motors- good qtr despite challenges, margin held at 10 pct

- Marico- earnings in-line, volume growth at 1 pct vs expected 0-2 pct

- L&T Info, Mindtree- Reports say merger may be announced shortly

- Blue Dart- revenue up 20 pct led by both realization and volume growth

Negative Read Through

- Voltas- EBIDTA down 21 pct, margin at 9.8 pct vs 12.5 pcy, EMP revenue down 21 pct YoY

- Ceat- Revenue up 13.3 pct, margin under pressure due to higher RM cost

- Force Motors- domestic sales slip 45 pct MoM, production at 1,338 units

A financial planning platform where you can plan all your goals, cash flows, expenses management, etc., which provides you advisory on the go. Unbiased and with uttermost data security, create your Financial Planning at Rs99/-

Disclaimer: The views shared in blogs are based on personal opinions and do not endorse the company’s views. Investment is a subject matter of solicitation and one should consult a Financial Adviser before making any investment using the app. Making an investment using the app is the sole decision of the investor and the company or any of its communication cannot be held responsible for it.