Though mutual funds are highly subject to market risks, despite it is one of the most lucrative investment avenues seen in the current market scenario. It can be seen that AMFI is highly promoting mutual fund investment through television commercials. When we talk about investment in mutual funds, the first & foremost thought that pops into our minds is SIP (Systematic Investment Plan). Even though, SIP is one of the safest and economical means of investment in a mutual fund; it is a tool for small players in the market. But if one has surplus funds lying idle, lump-sum or investment at once can prove to be a high yielding decision.

Factors to be considered before making lump-sum mutual fund investment

Parameter for Fund Selection

One of the most benevolent parameter as a reference for one-shot allocation of idle resources is the P/E (price per earnings ratio). Since equity mutual funds are a collection of shares, evaluation of funds on the basis of P/E ratio can be very helpful. P/E ratio is computed by dividing the market price per share (MPS) of the stock by its earnings per share (EPS). Suppose, MPS of stock A is Rs. 200 and EPS is Rs. 10, the P/E ratio is (200/10) = 20 i.e. stock A is trading at 20 times earnings.

P/E ratio of a mutual fund is the weighted average P/E ratio of all the stocks contained in the fund. The weights of the stocks are determined by their market values; let’s say, a fund consists of stocks of MN Ltd. worth Rs. 6,00,000 and PQ Ltd. worth Rs. 4,00,000, the total value of the fund Rs. 10,00,000, a weight of stock MN Ltd. is 60% and stock PQ Ltd. is 40%. If P/E ratios of stock MN Ltd. is 15 and stock PQ Ltd. is 10, then, fund’s P/E ratio is (0.6*15 + 0.4*10) = 13.

From the investment point of view, a lower P/E ratio is preferable. This implies that the average price of the shares in the fund as compared to the earnings of such companies comprising the fund is low. Lump-sum investment is favorable when the markets are at a low so that one can gain when the market starts improving.

Time the Investment

It is crucial to wait for the best opportunity to invest lump-sum in mutual funds in order to earn maximum returns. The best time for lump-sum investment in equity mutual funds is when the NAV (net asset value) of the fund is at its year’s low and there are probable chances to gain when the market takes an upturn. Investing when the NAV’s are low, larger units of a fund can be procured; this shall provide a broader base to earn when the fund makes an up-move.

Timing the market means how better one understands the market performance, predict the upcoming situation of the market, and allocate the resource when the best moment arrives.

Purposive Investment

The purpose of the investment should be to achieve the financial objective. If the investment is for the short term, it is better to invest in a liquid fund that is exposed to low risk and return and provides a hassle-free redemption option. Investment in a balanced fund is recommended for medium-term investment and for one having a long-term investment horizon, equity mutual funds can prove to be fruitful. Likewise, if the purpose is to save tax, then one can invest in ELSS funds which have a lock-in period of 3 years.

Must Read: – Top 6 things to avoid while investing in ELSS

Also, Mutual Funds require frequent monitoring to review whether the schemes are performing and attaining the determined objectives. Diversification of investment is necessary to reduce the risk that can arise from investment in a single fund if such fund starts deteriorating. Hence, funds churning and diversification ensures that the overall portfolio performs well despite any poor performance by a particular fund.

Consider the Tax Effect

Normally people invest in mutual funds by considering the return or yield capacity of the scheme, paying the least attention to the tax impact on the redemption of such fund. This can result in the drainage of a substantial portion of the gain made towards income tax. In the case of short-term investment; profit from investment in debt funds are subject to tax at the applicable slab rate and profit from equity-oriented funds are taxable @ 15%.

Profit from long-term investment, if the investment period is more than 3 years, debt funds attract a tax rate of 20% with indexation. However, Long-term capital gains from investment in equity-oriented funds are exempted from tax up to a gain of 1 lac. A realized gain of Rs. 1 lac and above in a financial year will attract a tax of 10%.

Systematic Transfer Plan (STP)

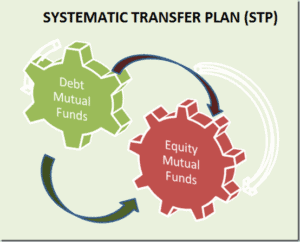

STP is a mix of SIP and lump-sum investment or a hybrid SIP. STP allows the periodical transfer of amount or units from one scheme to another of the same fund house, thus, helps in allocating funds at regular intervals.

One can target investment in an equity fund while remaining invested in a debt fund, thus ensuring high returns from equity funds and protection from part investment in debt funds.

The lump-sum mutual fund investment requires a cautious assessment of the factors affecting the market in which the investment is sought to be made. Resorting to these factors, you may be able to make a better investment decision.

To Invest and keep regular track of your portfolio download: Fintoo App Android http://bit.ly/2TPeIgX / Fintoo App iOS http://apple.co/2Nt75LP

Related Posts

Stay up-to-date with the latest information.