All you need to know about Tax saving under section 80C

Best Investment Options for Great Returns in F.Y 2022

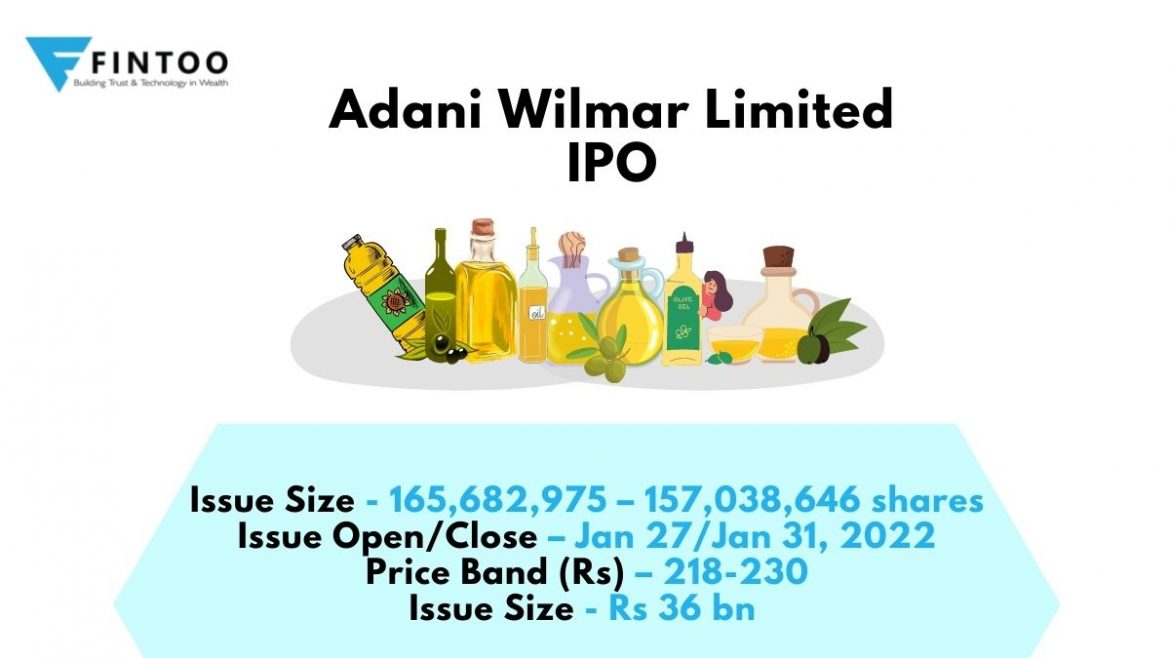

Adani Wilmar IPO – Date, Issue Size, Valuation

2022! Is It A ‘Bubble’, Ready To Pop?

Types Of Loans, Eligibility, Benefits Explained

Credit Card Frauds – How Financial Planning Helps